What Are Virtual Terminals? A Guide for Businesses

EBizCharge

JANUARY 21, 2025

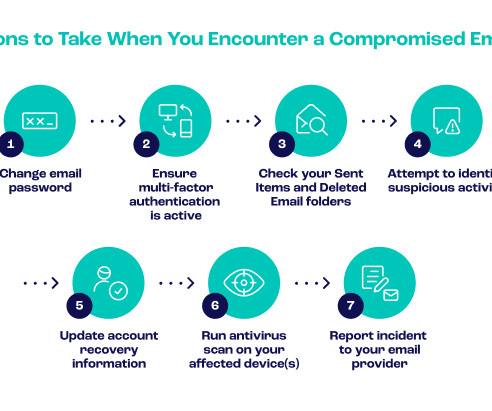

Secure payment processing: Data encryption ensures that credit card details and payment data are secure, reducing fraud risk. Virtual terminals should implement strong payment security measures like encryption, tokenization, address encryption, address verification, and secure gateways to prevent fraud and data breaches.

Let's personalize your content