Tokenisation 2.0: Are we ready for the next generation of payment security?

The Payments Association

JUNE 3, 2025

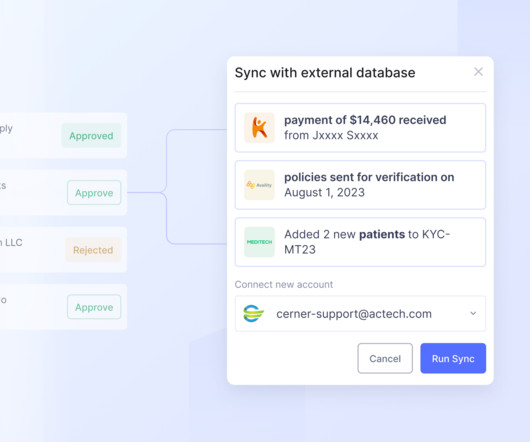

This shift is especially visible in the adoption of network tokenisationa model introduced by major card networks like Visa and Mastercard, where card details are replaced with dynamic, network-managed tokens. The necessity of tokenisation in digital payments The traditional view of tokenisation as a fraud mitigation tool is outdated.

Let's personalize your content