Walmart, Fiserv team to offer real-time payments

Payments Dive

SEPTEMBER 20, 2024

The retail giant and payments processor are targeting next year for offering consumers a real-time payment option online.

Payments Dive

SEPTEMBER 20, 2024

The retail giant and payments processor are targeting next year for offering consumers a real-time payment option online.

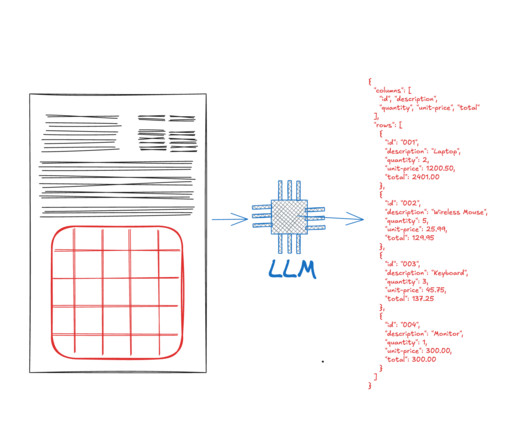

Nanonets

SEPTEMBER 20, 2024

Picture this - you’re drowning in a sea of PDFs, spreadsheets, and scanned documents, searching for that one piece of data trapped somewhere in a complex table. From financial reports and research papers, to resumes and invoices, these documents can contain complex tables with a wealth of structured data that needs to be quickly and accurately extracted.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

SEPTEMBER 20, 2024

The e-commerce platform will also let consumers connect their PayPal and Prime accounts next year, and access free shipping via Buy with Prime on some merchants’ sites.

The Payments Association

SEPTEMBER 20, 2024

How open banking can reshape finance, enabling personalised services, streamlined verification, and improved fraud detection.

Speaker: Jason Cottrell and Gireesh Sahukar

Retailers know the clock is ticking–legacy SAP Commerce support ends in 2026. Legacy platforms are becoming a liability burdened by complexity, rigidity, and mounting operational costs. But modernization isn’t just about swapping out systems, it’s about preparing for a future shaped by real-time interactions, AI powered buying assistants, and flexible commerce architecture.

Finovate

SEPTEMBER 20, 2024

You never know where Finovate Global will take you on any given week. In our last edition, we spent time in Spain with wealthtech GPTadvisor. Before that, we were talking about Ireland’s Central Bank and its search for top fintech talent, new investment in mobile payments in the Philippines , and the pace of digital transformation in India’s financial services sector.

The Fintech Times

SEPTEMBER 20, 2024

Since the cost of living crisis hit, the number of insurance claims has gone up. While many of these are valid, 65 per cent of insurance claims handlers have noticed an increase in fraudulent cases according to research from claims automation company, Sprout.ai. Two hundred insurance claims handlers were surveyed by Censuswide as part of the study and were asked how many cases they thought were fraudulent or manipulated by AI.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Finextra

SEPTEMBER 20, 2024

Safaricom and Mastercard have signed a partnership to accelerate the adoption of payment acceptance and cross-border remittance services in Kenya. This collaboration is set to benefit over 636,000 merchants using M-PESA, Safaricom’s leading mobile money service.

Fintech Finance

SEPTEMBER 20, 2024

Flutterwave , Africa’s leading payment technology company, has been named Company of the Year at the prestigious Innovation in Payments and Remittances (IPR) 2024 Awards held in London on September 17th, 2024. This recognition underscores Flutterwave’s unwavering commitment to excellence, innovation, and facilitating seamless cross-border payments for all individuals and businesses.

The Payments Association

SEPTEMBER 20, 2024

The new Reimbursement Claims Management System (RCMS) aims to simplify APP fraud claim processing, enhance PSP cooperation, and ensure adherence to updated compliance standards Read more

Fintech Finance

SEPTEMBER 20, 2024

Mastercard is proud to announce its title sponsorship of the 2024 Interbank Golf Tournament, in collaboration with the Kenya Bankers Association (KBA). Officially titled Interbank Golf Tournament 2024 – Presented by Mastercard , the prestigious event will kick off on 20 September at the renowned Royal Nairobi Golf Club. As a key event within the broader Interbank Sports Series, this tournament will see players from Kenya’s leading financial institutions compete in a showcase of strategy an

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Bank Automation

SEPTEMBER 20, 2024

Tech giants are bailing out on in-house financial services innovation as they look to embed their offerings into third-party vendor platforms. “After nearly a decade or more of big tech companies venturing into launching their own financial products, many of the major players have now pulled back,” Laura Kennedy, principal analyst at think tank CBInsights, […] The post Big tech pulls back on in-house financial services innovation appeared first on Bank Automation News.

Fintech Finance

SEPTEMBER 20, 2024

Comprising almost 10% of the Brazilian population, people with disabilities have a bank focused on their needs. Parabank , the world’s first digital bank focused on people with disabilities, is now launching credit and prepaid cards with a variety of benefits, including partnerships with rehabilitation clinics, a marketplace with products and services and access to investment services.

Finezza

SEPTEMBER 20, 2024

Maintaining cash flows efficiently is an important aspect of business growth. Companies budget a certain amount of funds to help meet their production expenses. However, sometimes, companies may need a sudden influx of cash to help fund an order of a larger ticket size. This is where access to invoice financing can help them fulfill […] The post Understanding the Types of Invoice Financing: Factoring vs.

Fintech Finance

SEPTEMBER 20, 2024

KOHO announces today their new partnership with Propel Holdings Inc. (“Propel”) (TSX: PRL). Through its Canadian brand Fora Credit, Propel will act as KOHO’s exclusive embedded lending partner. The partnership will allow qualified KOHO users to access a line of credit through Propel’s AI-powered lending platform within the KOHO app. “We’re proud to partner with Propel to further our mutual mission of empowering all Canadians to make financial progress.

Speaker: Benjamin Woll, Tiffany Spizzo, and Jaime Santos Alcón

Enterprise commerce is at an inflection point. Rigid, monolithic platforms slow brands down, but a full replatforming is disruptive and costly. Modular architecture offers a flexible, scalable alternative - allowing enterprise brands to modernize without ripping and replacing their entire stack. Learn how a composable approach helps modernize commerce stacks while maintaining control over critical systems.

Bank Automation

SEPTEMBER 20, 2024

Grasshopper Bank has reduced manual reviews in its onboarding process by 57% through fintech Alloy’s risk-management solution. The bank implemented Alloy’s Identity Risk Solution in March 2022. At the time, 20% of its applications were reviewed manually to monitor for fraud, Lauren McCollom, head of embedded finance at Grasshopper, told Bank Automation News.

Fintech Finance

SEPTEMBER 20, 2024

The Payments Association , the most influential community in payments, and We Fight Fraud , an organisation that focuses on tackling financial crime, and supported by Cardaq , has released an investigative documentary exploring the potential impact of new authorised push payments (APP) legislation on consumers. It is also, crucially for the first time, exploring the new rules through the eyes of the criminal and how easily they will exploit them for their own ill-gotten gains. ‘ The New APP Rule

Finextra

SEPTEMBER 20, 2024

A new Fair Payment Code has been announced by the UK government to manage late payments that cost SMEs.

Fintech Finance

SEPTEMBER 20, 2024

The government has unveiled new measures to support small businesses and the self-employed by tackling the scourge of late payments, which is costing small businesses £22,000 a year on average and leads to 50,000 business closures a year. The government will consult on tough new laws which will hold larger firms to account and get cash flowing back into businesses – helping deliver our mission to grow the economy.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

The Paypers

SEPTEMBER 20, 2024

The Monetary Authority of Singapore (MAS) and the Association of Banks in Singapore (ABS) have announced that major retail banks are set to implement Singpass Face Verification (SFV).

Fintech Finance

SEPTEMBER 20, 2024

NMI ®, a global leader in embedded payments, has partnered with INIT , a leading supplier of public transit ticketing solutions, to implement a cutting-edge payment processing solution for the San Diego Metropolitan Transit System (MTS). This collaboration showcases a new “Tap-on/Tap-off” model that enhances both convenience and security for daily commuters on MTS buses and trolleys.

The Fintech Times

SEPTEMBER 20, 2024

Following the 2023 Lending Standards Board (LSB) report, which underscored the crucial role that financial institutions can play in unlocking the untapped potential of Ethnic Minority-Led Businesses (EMBs), the non-profit organisation is developing a new inclusive Code to drive essential improvements in access to finance for these firms. In 2023, the LSB reported that ethnic minority entrepreneurs, including those from Black, Asian, and other minority groups, contribute an estimated £25billion t

Fintech Finance

SEPTEMBER 20, 2024

Safaricom and Mastercard have signed a partnership to accelerate the adoption of payment acceptance and cross-border remittance services in Kenya. This collaboration is set to benefit over 636,000 merchants using M-PESA, Safaricom’s leading mobile money service. Kenya’s payment acceptance market continues to grow, with mobile wallet payments driven by M-PESA showing a 12.7% CAGR between 2020 and 2024.

Speaker: Becky Parisotto and John Vurdelja

Fulfillment is no longer just about getting products from point A to point B – it's about crafting seamless, scalable, customer first experiences. Flexible fulfillment strategies are more important than ever for those aiming to stay ahead and build resilience as retail enters a new era in 2025. Learn how to optimize fulfillment processes, tackle complex, multi-vendor orders, and create seamless customer experiences – from white-glove delivery for high-value items to quick-ship solutions for ever

The Paypers

SEPTEMBER 20, 2024

Astra Tech , a consumer technology holding company, has launched a service in the UAE called ‘Send Now, Pay Later’ (SNPL) through its Botim Ultra App.

Finextra

SEPTEMBER 20, 2024

In a speech at Kew Gardens on Monday, UK Foreign Secretary David Lammy spoke on how the UK government will be realigning its priorities to commit to green initiatives and combatting climate change.

The Paypers

SEPTEMBER 20, 2024

Privado ID , formerly known as Polygon ID, has announced its merger with Disco , a company focused on multichain verifiable data and reputation management.

The Fintech Times

SEPTEMBER 20, 2024

With the B2B commerce industry rapidly changing, it should come as no surprise that some finance teams are struggling to keep up. However, new research by Hokodo , the provider of flexible payment terms for European merchants and marketplaces, reveals that as much as two-thirds of the industry is failing to keep pace. In the new investigative report, produced in partnership with the B2B eCommerce Association , Hokodo reveals that 66 per cent of finance leaders say their team is unable to keep pa

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

The Paypers

SEPTEMBER 20, 2024

Vietnam Maritime Commercial Joint Stock Bank (MSB) has partnered with TerraPay to enhance digital payment solutions by improving efficiency and reducing transaction costs.

The Fintech Times

SEPTEMBER 20, 2024

In a wide-ranging discussion, Heath Behncke, managing director of Holon , shared his insights on how developments in technology, energy efficiency and the role of blockchain is enabling more transparent and trustworthy data management. Behncke began by highlighting the growing importance of energy efficiency across various technological applications, from Bitcoin mining to cloud computing. “The whole theme these days is about the sheer volume of energy and space required for everything, wh

Finovate

SEPTEMBER 20, 2024

Walmart is partnering with Fiserv to enable pay-by-bank payments for online purchases starting in 2025. Benefits to Walmart include lower transaction costs, faster settlement, reduced fraud, and fewer payment declines, while customers can avoid stacked pending transactions. Consumers may face challenges like added friction and lost credit card rewards, but early pilot results have exceeded Walmart’s expectations for pay-by-bank adoption.

The Fintech Times

SEPTEMBER 20, 2024

Crypto transactions will become more seamless and secure following a new partnership between Mesh , a modern connectivity layer for crypto that makes transfers and account aggregation more seamless, and CoinMENA FZE , a digital assets trading platform in the Middle East. This collaboration aims to enhance digital asset transfer services by allowing the CoinMENA platform to be embedded into Mesh’s product suite.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Let's personalize your content