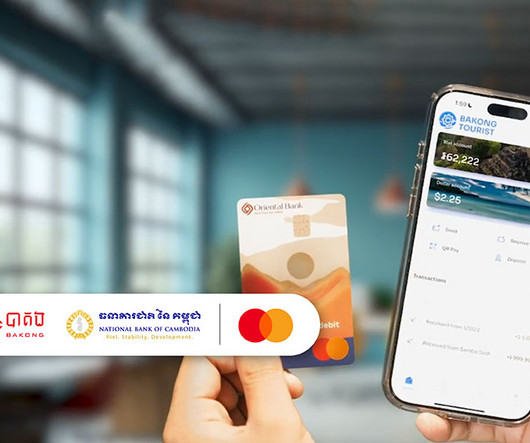

Cambodia and Mastercard Roll Out ‘Bakong Tourists’ App for Seamless Payments

Fintech News

NOVEMBER 11, 2024

The National Bank of Cambodia (NBC) has launched the Bakong Tourists app in collaboration with Mastercard at a ceremony in Phnom Penh. The app simplifies digital payments for international tourists visiting Cambodia. Tourists can download the app upon arrival and seamlessly top up their Bakong accounts using their Mastercard issued in their home countries.

Let's personalize your content