Revolutionizing API traffic management with artificial intelligence

Axway

SEPTEMBER 10, 2024

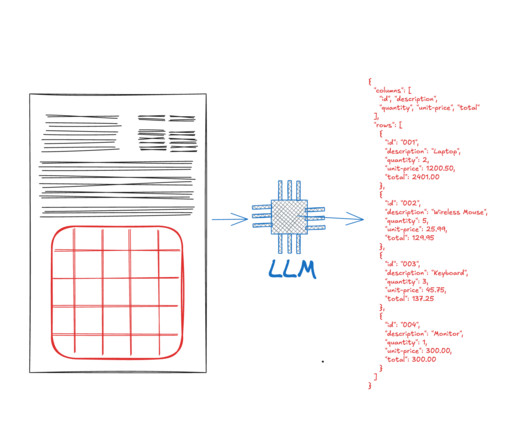

In the interconnected world of modern software development, Application Programming Interfaces (APIs) are the critical conduits that enable diverse systems to communicate and interact. Efficient traffic management for APIs is crucial to ensure performance, reliability, and security.

Let's personalize your content