Illinois heads toward landmark card interchange fee restrictions

Payments Dive

JUNE 7, 2024

The state may become the first in the nation to outlaw the imposition of credit and debit card interchange fees on state excise tax and tips.

Payments Dive

JUNE 7, 2024

The state may become the first in the nation to outlaw the imposition of credit and debit card interchange fees on state excise tax and tips.

VISTA InfoSec

JUNE 7, 2024

As flexible working arrangements become increasingly common across every industry, companies need secure, dependable ways to grant remote employees online access to company data, services, and applications. Productivity in today’s highly digital business environment depends upon employees being able to access the systems and information they need for work when needed, from any location.

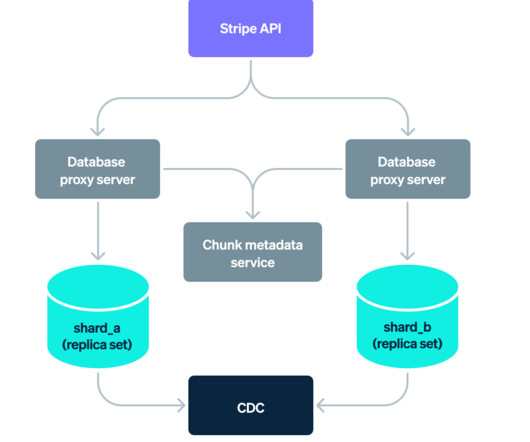

Stripe

JUNE 5, 2024

In this blog post we’ll share an overview of Stripe’s database infrastructure and discuss the design and application of the Data Movement Platform.

Finextra

JUNE 5, 2024

The Bank for International Settlements says it multi-central bank CBDC platform, Project mBrige, is ready to accept value added products and new use cases as it reaches minimum viable product stage (MVP).

Speaker: Jason Cottrell and Gireesh Sahukar

Retailers know the clock is ticking–legacy SAP Commerce support ends in 2026. Legacy platforms are becoming a liability burdened by complexity, rigidity, and mounting operational costs. But modernization isn’t just about swapping out systems, it’s about preparing for a future shaped by real-time interactions, AI powered buying assistants, and flexible commerce architecture.

Payments Dive

JUNE 3, 2024

Block is working to make its peer-to-peer payments tool, Cash App, a consumer app for interacting with merchants using its Square point-of-sale software.

Fintech News

JUNE 2, 2024

Swift, the global financial messaging cooperative, has announced two AI-driven experiments in collaboration with member banks to combat cross-border payments fraud which could potentially save the industry billions in fraud-related costs. The first pilot aims to enhance Swift’s existing Payment Controls service, which detects fraud indicators, by using an AI model to create a more accurate picture of potential fraud activity.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

VISTA InfoSec

JUNE 3, 2024

If your company has ever worked with businesses in European Union countries, you probably had to follow the EU’s General Data Protection Regulation (GDPR). This rule, which started on May 25, 2018, gives customers more control over their data and makes data collection and use more transparent. A big part of the GDPR is protecting people’s privacy and data from unauthorized access.

Payments Dive

JUNE 6, 2024

State lawmakers are negotiating three separate proposals related to the buy now, pay later industry ahead of the end of the legislative session on Thursday.

Finextra

JUNE 6, 2024

Megan Caywood Cooper, former Barclays chief product officer and Starling chief platform officer, has announced her new AI wealthtech Caywood, at Money 20/20 today.

Fintech News

JUNE 3, 2024

The Asia-Pacific (APAC) region faces significant challenges in combating money laundering due to its diverse economies, large volume of cross-border trade, and varying levels of regulatory enforcement across different countries — the trends of money laundering in Asia Pacific are constantly evolving. However, enhanced regulatory measures, technological advancements and increased public-private and international collaboration are introducing promising opportunities to address these challeng

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

The Fintech Times

JUNE 2, 2024

Fraud prevention decision-makers across Europe are well aware of the growth and danger of AI-driven identity and financial fraud, but are unprepared to combat it, Signicat , the European digital identity and fraud prevention solution provider, has revealed in a new report. ‘ The Battle against AI-driven Identity Fraud ‘ study by Signicat delves into how organisations across Europe are battling the growing threat of AI-driven identity fraud.

Payments Dive

JUNE 5, 2024

The Safer Banking Act and federal rescheduling of marijuana could simplify transactions for payments companies doing business in the arena.

Bank Automation

JUNE 5, 2024

AMSTERDAM — ING is using generative AI in its know-your-customer processes to boost productivity for its data analysts and improve the client experience. The generative AI efforts for KYC have both an operational and client benefit, Marnix van Stiphout, chief operating officer and chief technology officer ad interim at 976 billion euros ($1.

Finextra

JUNE 4, 2024

At Money 20/20 Europe, Mehret Habteab, senior VP of product and solutions at Visa Europe, announced the company generated $40 billion in incremental e-commerce revenue globally, after issuing over 10 billion tokens since their launch in 2014.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

The Fintech Times

JUNE 1, 2024

Fraudsters continue to pose huge issues for the financial sector across the globe. UK Finance recently revealed that criminals stole over £1billion in 2023 alone. Even worse, the fraud landscape shows no signs of improving, as bad actors increasingly utilise AI to increase the damage done to financial organisations. However, many of the largest financial organisations worldwide are actively investigating measures to counteract these threats.

Payments Dive

JUNE 3, 2024

Customers have multiple ways to access your products and brand, but do those experiences work together for their benefit—and yours?

Fintech News

JUNE 3, 2024

Indonesia’s fintech landscape is booming. Over the past decade, the number of fintech players in Indonesia increased six-fold, rising from just 51 active players in 2011 to 334 in 2022, a 2023 report by AC Ventures and the Boston Consulting Group shows, highlighting Indonesia’s fintech investors growing interest in the segment Number of Indonesian fintech companies by segment, Source: Indonesia’s Fintech Industry is Ready to Rise, AC Ventures/BCG Group, March 2023 This growth has emerged o

Finextra

JUNE 2, 2024

In the rapidly evolving landscape of financial technology, the convergence of innovative digital sol.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Finovate

JUNE 3, 2024

PayPal’s stablecoin, PayPal USD (PYUSD), was officially added to the Solana Blockchain last week. This shift comes after the California-based company launched on Ethereum blockchain last summer. Now, PayPal stablecoin users can send PYUSD on Ethereum or Solana when transferring out to external wallets. “For more than 25 years, PayPal has been at the forefront of digital commerce, revolutionizing commerce by providing a trusted experience between consumers and merchants around the wor

The Fintech Times

JUNE 3, 2024

Using the world’s largest proprietary risk and threat intelligence dataset, SecurityScorecard , the cybersecurity analyser, studied cybersecurity breaches across the UK’s 100 largest companies by market capitalisation, releasing a comprehensive analysis of the landscape of the FTSE 100 in the UK. Fraudsters are having to adapt to new cybersecurity measures as a result of greater cyber protection of primary avenues.

Fintech News

JUNE 2, 2024

Vietnam’s Southeast Asia Commercial Joint Stock Bank (SeABank) and Visa have entered into a strategic agreement to enhance digital payments. This partnership aims to improve SeABank ‘s payment solutions, data capacity, and expertise, advancing their payment services strategy. Visa and SeABank will focus on five key areas namely enhancing the customer experience on digital platforms, improving card products and services, optimising the card service ecosystem, boosting marketing and co

Finextra

JUNE 3, 2024

UK digital bank Monzo is preparing to expand into the US and Europe after reporting its first full year of profitability, achieving a pre-tax profit of £15.4m for the financial year ended 31 March 2024.

Speaker: Benjamin Woll, Tiffany Spizzo, and Jaime Santos Alcón

Enterprise commerce is at an inflection point. Rigid, monolithic platforms slow brands down, but a full replatforming is disruptive and costly. Modular architecture offers a flexible, scalable alternative - allowing enterprise brands to modernize without ripping and replacing their entire stack. Learn how a composable approach helps modernize commerce stacks while maintaining control over critical systems.

Fintech Review

JUNE 4, 2024

By Nikolay Seleznev , Chief Strategy and Business Development Officer at Uzum The descendants of those who traded on the Silk Road are now embracing a new vehicle for commerce: fintech. For years unable to access innovative finance and technology products, Uzbeks are making up for lost time. In a country and a region which is enjoying robust growth and undertaking a program of economic modernisation, the market for Uzum – and other digital service ecosystems – is growing at an exponential rate.

Payments Dive

JUNE 4, 2024

Takis Georgakopoulos, a 17-year veteran at the bank, will be replaced by two colleagues being promoted to co-head roles.

Fintech News

JUNE 2, 2024

Moca Technology and Services Joint Stock Company (Moca) has announced that it will cease providing its e-wallet services on both the Moca and Grab applications in Vietnam, effective 1 July 2024. The Moca wallet, integrated within the Grab app, has been a popular payment method for Grab users in Vietnam. Despite this change, Moca will remain a strategic partner for Grab’s online payment activities, offering intermediary payment services across the Grab ecosystem in Vietnam.

Finextra

JUNE 3, 2024

Savings app Yotta says 85,000 customers have been locked out of their accounts for three weeks because of the collapse of BaaS platform Synapse.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Fintech Finance

JUNE 6, 2024

Elavon , a wholly-owned subsidiary of U.S. Bank and one of the largest payments processors globally, is partnering with Southeastern Pennsylvania Transportation Authority (SEPTA) to offer contactless payment acceptance from any enabled card or mobile device across transit services. SEPTA is one of the ten largest transit systems in the United States.

Finovate

JUNE 5, 2024

The U.S. Small Business Administration plans to issue a new SBA loan option for small businesses. The new pilot program will extend lines of credit of up to $5 million and will charge an annual fee and a maximum interest rate that is 3% to 6.5% higher than the prime rate. Lenders will receive a 75% guaranty on loans larger than $150,000 and an 85% guaranty on loans smaller than $150,000.

Fintech News

JUNE 5, 2024

Australia will introduce new legislation to amend the Credit Act, requiring Buy Now, Pay Later (BNPL) providers to hold an Australian credit license and comply with existing credit laws regulated by the Australian Securities and Investments Commission (ASIC). Currently, most BNPL products are not covered by the National Consumer Credit Act, leaving consumers without the same protections such as affordability checks that apply to credit cards and loans.

Finextra

JUNE 7, 2024

A UK tribunal has ruled that interchange fee lawsuits against Visa and Mastercard can proceed.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Let's personalize your content