Don’t know what a digital wallet is? We’ve got you covered.

Payments Dive

DECEMBER 20, 2023

This primer fills in the gaps on how digital wallets work, what companies compete to provide such payment tools and what to expect from them in the future.

Payments Dive

DECEMBER 20, 2023

This primer fills in the gaps on how digital wallets work, what companies compete to provide such payment tools and what to expect from them in the future.

Stax

DECEMBER 20, 2023

When you research payment solution providers , you’ll start hearing the term “interchange” used when talking about payments. Interchange is the fee that credit card companies like Visa and Mastercard charge businesses to accept their cards. The interchange fee depends on a number of factors and isn’t always easy to understand. In this article, we will break down credit card interchange fees so you will know exactly how much you’re spending when running your business.

Fintech News

DECEMBER 17, 2023

Traditional banking systems, burdened by age and complexity, can cripple innovation, restrain time to value, and strain customer relationships. This is not an isolated challenge; many incumbent banks struggle to keep ownership and maintenance costs in check and swiftly expand product offerings to compete with nimble challenger banks. Digital transformation is no longer a choice; it’s a lifeline.

The Fintech Times

DECEMBER 18, 2023

It’s a time of reflection and anticipation at The Fintech Times throughout December, as we look back at developments and trends over the last 12 months and forward to the year ahead. We’re pleased to share the thoughts of fintech CEOs and industry leaders from across the globe to 2023’s key takeaways and what we should expect to be top of the agenda in 2024.

Speaker: Jason Cottrell and Gireesh Sahukar

Retailers know the clock is ticking–legacy SAP Commerce support ends in 2026. Legacy platforms are becoming a liability burdened by complexity, rigidity, and mounting operational costs. But modernization isn’t just about swapping out systems, it’s about preparing for a future shaped by real-time interactions, AI powered buying assistants, and flexible commerce architecture.

Payments Dive

DECEMBER 21, 2023

Google’s settlement with attorneys general this week includes a lengthy list of changes the tech titan must make in its approach to in-app payments.

TechCrunch Fintech

DECEMBER 17, 2023

Welcome back to The Interchange, where we take a look at the hottest fintech news of the previous week. If you want to receive The Interchange directly in your inbox every Sunday, head here to sign up! What a year This is the last edition of The Interchange for 2023 — it’s hard to believe that the […] © 2023 TechCrunch. All rights reserved. For personal use only.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

The Finance Weekly

DECEMBER 20, 2023

If you're in charge of a team, you understand the importance of using ,, workforce planning software in today's business world. Without the right tools tailored to your company's needs, it's challenging to keep up and stay competitive. This article will highlight essential features to seek in workforce management tools and then introduce some top choices to enhance your workflow.

Payments Dive

DECEMBER 22, 2023

The Electronic Payments Coalition is “fully funded” for the continuing fight over the proposed Credit Card Competition Act next year, said the organization’s executive chairman.

Fintech News

DECEMBER 19, 2023

The global fintech landscape is witnessing a staggering growth, fueled by booming consumer adoption, supportive regulatory efforts and technological advancements. Between 2015 and 2019, consumer adoption of digital money transfer and payment services grew from a mere 18% to an impressive 75%, findings from a Statista survey found. Insurtech, alternative lending and online savings and investment recorded similar spectacular growths, surging between 20 to 40 points during the period.

Finextra

DECEMBER 20, 2023

The payments industry's ever-evolving nature blends innovation and change, traversing various paths.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

The Finance Weekly

DECEMBER 20, 2023

If you're in charge of a team, you understand the importance of using ,, workforce planning software in today's business world. Without the right tools tailored to your company's needs, it's challenging to keep up and stay competitive. This article will highlight essential features to seek in workforce management tools and then introduce some top choices to enhance your workflow.

Payments Dive

DECEMBER 19, 2023

Beating back fraud can feel “a bit like a vicious circle,” as the industry improves its capabilities and fraudsters pivot, said Tina Eide, an executive vice president focused on fraud at the card issuer.

BlueSnap

DECEMBER 21, 2023

For many businesses, 2023 has been about making the most of the time, resources and money at hand. Our most read content within our Resource Center says a lot about what businesses are thinking about payments today and their impact on the bottom line. The post The Best of BlueSnap: The Top 10 Payment Content Pieces of 2023 appeared first on BlueSnap.

Fintech News

DECEMBER 17, 2023

Paywatch, an earned wage access (EWA) provider, announced that it has officially expanded its services into Indonesia following its Philippines’ launch in October this year The firm revealed that it had recently partnered with an unnamed local banking partner to launch its bank-backed EWA service in Indonesia. Since the launch of that partnership, Paywatch said that it has grown within the local manufacturing and financial sectors.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

NFCW

DECEMBER 19, 2023

Chinese visitors will soon be able to use digital yuan for “tourist spending” in Singapore as part of a pilot to test the use of China’s central bank digital currency (CBDC) for cross-border payments. The pilot will also enable Singaporeans to make purchases with digital yuan when they visit China, according to the Monetary Authority of Singapore (MAS).

Payments Dive

DECEMBER 20, 2023

The Minneapolis-based lender flagged a CFPB probe into prepaid card use last year. The OCC added a separate penalty Tuesday.

Finextra

DECEMBER 18, 2023

As 2023 draws to a close, the insurance industry faces a landscape rich with possibilities and fraug.

Fintech News

DECEMBER 20, 2023

Home Credit, an Indonesian consumer finance company, has secured an investment of US$100 million from Mitsubishi UFJ Financial Group’s (MUFG) division in the country, according to a report by Tech in Asia. This new capital injection will be strategically allocated towards financing initiatives that are aligned with Environmental, Social, and Governance (ESG) principles.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

NFCW

DECEMBER 20, 2023

The European Council has agreed updated proposals for amendments to the European Union’s Directive on Driving Licences that lay out the legislative basis for integrating mobile driving licences into the European Digital Identity Wallet. The proposals were originally made by the European Commission and also allow for “the alignment of the technical elements for mobile driving licences with the revision of the digital identity (eIDAS) regulation and better link between the adoption of implementing

TechCrunch Fintech

DECEMBER 22, 2023

As 2023 comes to a close, we’re here to look back at the biggest fintech stories of the year. Silicon Valley Bank’s implosion felt like a fintech story in that a number of startups (Brex, Arc and Mercury, for example) in the space leapt to fill the hole left by its collapse. But it truly […] © 2023 TechCrunch. All rights reserved. For personal use only.

Finextra

DECEMBER 20, 2023

Walmart has struck a deal with Affirm to offer buy now, pay later options at self-checkout kiosks at over 4500 US stores.

Fintech News

DECEMBER 20, 2023

JULO, an Indonesian fintech offering digital peer-to-peer lending, announced that it has launched ‘JULO Cares’, an embedded insurance coverage. This new offering, backed by global general insurer Sompo, provides device protection for users availing of JULO’s digital credit services. Throughout 2023, JULO has focused on launching new products aimed at supporting Indonesia’s underbanked and unbanked populations.

Speaker: Benjamin Woll, Tiffany Spizzo, and Jaime Santos Alcón

Enterprise commerce is at an inflection point. Rigid, monolithic platforms slow brands down, but a full replatforming is disruptive and costly. Modular architecture offers a flexible, scalable alternative - allowing enterprise brands to modernize without ripping and replacing their entire stack. Learn how a composable approach helps modernize commerce stacks while maintaining control over critical systems.

NFCW

DECEMBER 18, 2023

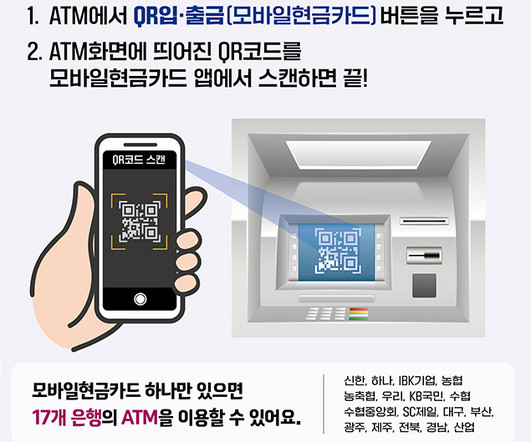

SCAN: Availability is being expanded from NFC on Android phones to QR Codes on all smartphones Consumers in Korea can now make cash withdrawals and deposits at ATMs by scanning a QR code with their Apple or Android smartphone rather than needing to use a physical bank card. The service launched by the Bank of Korea is being made available by 17 banks including Shinhan Bank , KB Kookmin Bank , Hana Bank , Woori Bank and NH Nonghyup Bank , enabling users to deposit or withdraw cash at their ATMs f

The Fintech Times

DECEMBER 21, 2023

It’s a time of reflection and anticipation at The Fintech Times throughout December, as we look back at developments and trends over the last 12 months and forward to the year ahead. We’re excited to share the thoughts of fintech CEOs and industry leaders from across the globe to 2023’s key takeaways and what we should expect to be top of the agenda in 2024.

Finextra

DECEMBER 21, 2023

Eastern Bank in India is launching what it claims is the world's first biometric metal card for premium customers.

Fintech News

DECEMBER 20, 2023

Payment giant Mastercard has partnered with PT MRT Jakarta (Perseroda) to provide more payment options to commuters for cashless transit experiences. This announcement coincides with the renaming of Senayan Station to Senayan Mastercard Station. Travelers can now top up their MRT cards using Mastercard debit cards at station counters. Additionally, for the first time, Mastercard credit cards are now accepted for ticket purchases through the MyMRTJ app.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

NFCW

DECEMBER 22, 2023

NFCW is taking a short break for the festive season. The team here would like to thank all our readers, event attendees, sponsors and partners for their enthusiasm and support over the last 12 months, and we wish you all a peaceful holiday and every success for 2024. NFCW will return on Wednesday 3 January. Stay safe! Happy Holidays from NFCW was written by Mike Clark and published by NFCW.

The Fintech Times

DECEMBER 19, 2023

Buy now, pay later (BNPL) services have become significant in the realm of short-term unsecured consumer finance, often tied to specific products and offering instalment repayments, without accruing interest. The BNPL transaction involves three key players: the consumer, the merchant, and the BNPL service provider. Despite the similarities with traditional credit products, there is an ongoing discussion about whether BNPL services should be subject to comparable regulatory measures.

Finextra

DECEMBER 18, 2023

Real-time payments platform Volt has teamed up with sustainability fintech ekko to help retailers and their customers support the removal of plastic bottles from the ocean.

Fintech News

DECEMBER 20, 2023

Obligate, a Swiss capital markets platform operating on blockchain technology, has facilitated the issuance of a USDC-denominated bond by the USD TradeFlow Fund. This development was executed on the Polygon blockchain. TradeFlow Capital Management , is a Singapore-based advisory firm to the USD TradeFlow Fund and a member of the Supply@ME Capital Group, utilises a non-credit, fintech-enabled strategy for supporting SME physical commodity import and export transactions.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Let's personalize your content