How to Choose Between EFT vs ACH: A Comprehensive Guide

Stax

MARCH 27, 2025

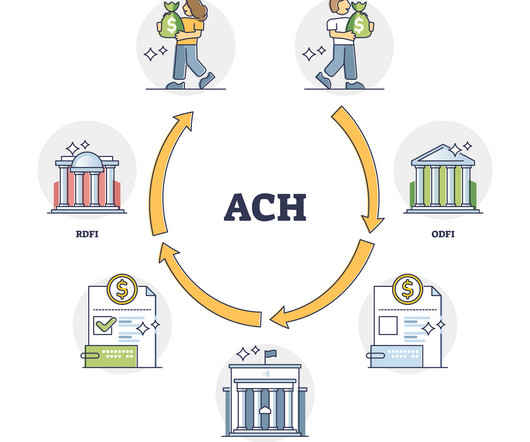

Payments can also be made to local vendors via electronic bank transfers, or fund global transactions with wire transfers. Understanding ACH Payments: The Backbone of Bank Transfers EFT is like a toolbox for digital payments, while ACH is one of the most reliable tools you can find inside. per transaction.

Let's personalize your content