Facilitating Access to Finance in Underserved Communities Through Digital Banking

The Fintech Times

JULY 16, 2025

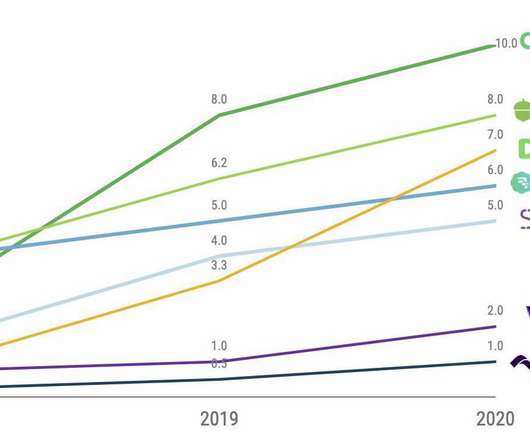

According to the World Bank , the number of adults without access to financial services has dropped from 2.5 Having explored some of the biggest financial inclusion hurdles in digital banking, we now turn our attention to why it is so important that these challenges are overcome. billion in 2011 to 1.4 billion in 2021.

Let's personalize your content