Identity Fraud Surges in Scale and Sophistication, with APAC’s Financial Services Becoming a Prime Target

Fintech News

APRIL 25, 2025

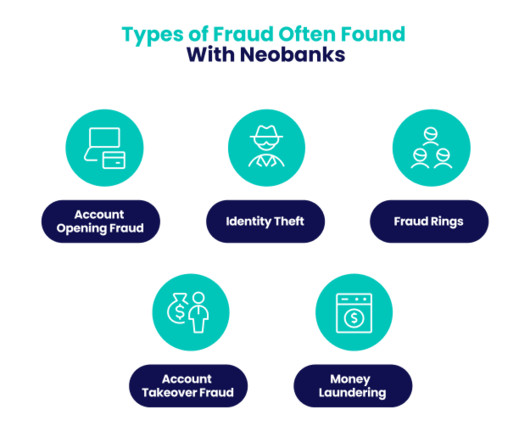

Data from identity verification specialist Sumsub reveal that identity fraud incidents have more than doubled in the past three years, with account takeovers and deepfakes emerging as major concerns. Notably, account takeovers witnessed a remarkable increase, increasing by 250% year-over-year (YoY) on a worldwide basis.

Let's personalize your content