What You Need to Know About Singapore’s Most Common Payment Fraud

Fintech News

FEBRUARY 4, 2025

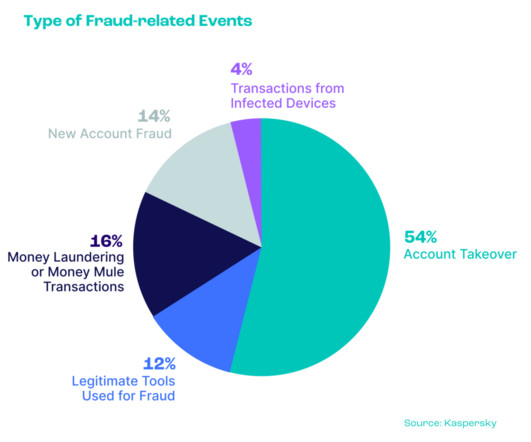

Unlike its regional counterparts, where fraud types like triangulation fraud and account takeover fraud are more common, Singapore has seen a rise in more sophisticated and creative forms of fraud. With its high level of digital payments maturity, the country has witnessed shifting trends in fraudulent activities.

Let's personalize your content