Case Study: Fraud.net Reduces Account Takeovers by 90% for Tinka

Fraud.net

JULY 29, 2024

Learn how Fraud.net's award-winning platform helped a BNPL payment processor reduce account takeovers, first payment defaults, and fraud.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Fraud.net

JULY 29, 2024

Learn how Fraud.net's award-winning platform helped a BNPL payment processor reduce account takeovers, first payment defaults, and fraud.

Seon

JANUARY 29, 2024

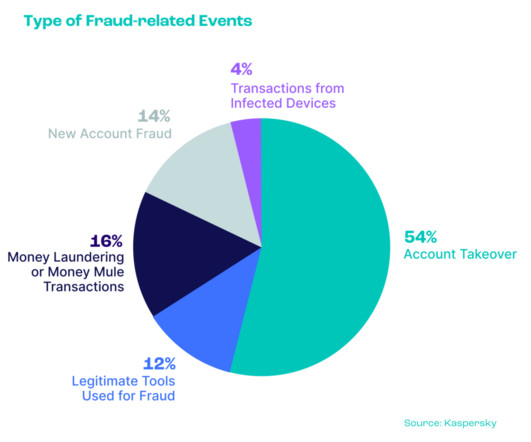

In this guide, we’ll see why accounts are targeted, how fraudsters acquire them, and, of course, which steps you should take to secure them. This is your complete guide to understanding and detecting account takeover (ATO) fraud in your business. What Is Account Takeover Fraud?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Fraud.net

DECEMBER 1, 2023

Modern account takeover protection requires implementing machine learning, geolocation, and anomaly detection to spot and prevent ATO fraud.

PYMNTS

OCTOBER 23, 2017

Security, Ersell said, is an old business, and it’s still ruled by the same love triangle of warring priorities: security, convenience and resources. Ersell’s organization specializes in credit card and eCommerce fraud (including account takeover), which calls for different skills and strategies than, say, hacking into merchants’ websites.

PYMNTS

DECEMBER 18, 2020

Cybercriminals are well aware that merchants are setting higher thresholds for blocking transactions, which is a major flaw of rules-based fraud prevention strategies.”. He said rules-based systems often fail to find high-dollar fraudulent transactions, but do often block legitimate transactions along the way.

The Payments Association

MAY 21, 2025

Organised crime groups target FIs and their customers, adapting attack methods across payment channels to bypass fraud detection systems, with authorised push payment fraud (APPF), account takeover (ATO) fraud, and AI-enabled deep fake scams. trillion in illicit funds flowing through the global financial system. The results are clear.

PYMNTS

OCTOBER 24, 2018

Rules of thumb are useful — until they aren’t. When it comes to deploying corporate resources in the battle against online fraud and account takeovers (ATOs), all too often, guiding principles fail to spot what’s really happening to a business in real time. Thumbs Down On Rules Of Thumb? The Big Disconnect.

Finextra

JULY 1, 2025

And, as victims of Account Takeover (ATO) fraud continue to grow, the challenge is no longer just about preventing fraud, its about restoring customer confidence in a digital landscape where trust has become the most valuable currency. Customers experience the advanced security measures as a seamless, almost invisible process.

Fi911

DECEMBER 3, 2024

The underlying technology of velocity checks uses an algorithm that juxtaposes historical user data with present transactional data under a predefined set of rules. Should a user conduct a series of transactions inconsistent with their historical data, these transactions are flagged for review.

FICO

JULY 23, 2019

Here, I will broaden the focus to include account takeover fraud. As CSPs have looked to introduce additional controls and checks at the front-end onboarding process, fraudsters have moved to account takeover. In my next post I’ll look at analytics that can help CSPs manage subscription fraud and account takeover fraud.

FICO

JULY 23, 2019

Here, I will broaden the focus to include account takeover fraud. As CSPs have looked to introduce additional controls and checks at the front-end onboarding process, fraudsters have moved to account takeover. In my next post I’ll look at analytics that can help CSPs manage subscription fraud and account takeover fraud.

FICO

JULY 23, 2019

Here, I will broaden the focus to include account takeover fraud. As CSPs have looked to introduce additional controls and checks at the front-end onboarding process, fraudsters have moved to account takeover. In my next post I’ll look at analytics that can help CSPs manage subscription fraud and account takeover fraud.

PYMNTS

SEPTEMBER 29, 2017

Account takeover and the creation of false accounts, Webster and Brown agreed, will be the massive twin issue that financial services players will have to address rather quickly. What we can help with is fighting back the account takeovers and consumer hacks that are now going to be ongoing.”.

PYMNTS

JULY 9, 2020

Banks have been facing a concerning rise in account takeover (ATO) attacks targeting their customers, with financial institutions (FIs) losses due to such schemes rising 72 percent from 2018 to 2019. The July FI Fraud Decisioning Playbook examines how FIs are working to better detect and defend against ATOs.

PYMNTS

APRIL 13, 2020

That snapshot can very accurately identify unique customers from speculators who keep coming back — which is critical to helping eCommerce providers to implement rules and restrict purchases so they don’t run out of stock and they can actually help their actual customers instead of speculators who want to gouge them.”.

Fintech Finance

MARCH 3, 2025

Built-in fraud protection prevents e-wallet account takeover risks. Intuitive risk management platform empowers merchants to design, test and deploy customized fraud prevention rules. Multi-Party Computation (MPC)-based AI risk management and mobile device security system ensure every transaction is secure.

Fi911

JUNE 9, 2025

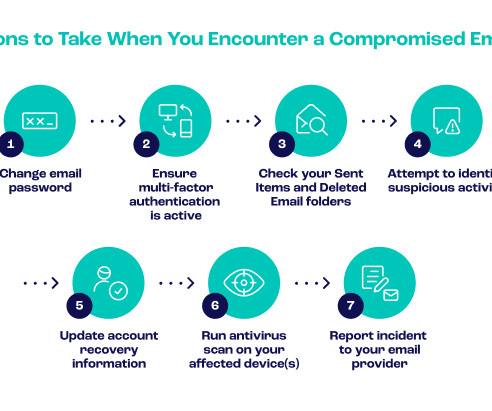

Rules should flag emails with slight domain variations, urgent payment requests, or changes to banking details. Sandboxing suspicious attachments prevents malware that could enable account takeovers. Multi-factor authentication protects against credential compromise but must extend beyond employee accounts.

Finextra

JUNE 26, 2025

Account takeover attacks Account takeover attempts by criminals: Account takeover (ATO) attempts involve criminals gaining unauthorized access to online accounts, often through stolen or compromised credentials. We use cookies to help us to deliver our services. Please read our Privacy Policy.

Fintech Finance

AUGUST 2, 2024

The solution integrates seamlessly with financial systems, providing real-time alerts, customizable rule engines, and robust data management for effective transaction validation and risk management. Pre-Payment Security : Device fingerprinting, biometric authentication, and real-time monitoring to prevent identity fraud and account takeover.

The Payments Association

JUNE 11, 2025

Account takeover attacks exploit credential stuffing and social engineering techniques, with UK finance recording 34,114 cases of card identity theft in the first half of 2022 alone, leading to gross losses of £21.4 Traditional attack vectors continue to evolve alongside these new threats.

Finextra

JUNE 26, 2025

Account takeover attacks Account takeover attempts by criminals: Account takeover (ATO) attempts involve criminals gaining unauthorized access to online accounts, often through stolen or compromised credentials. We use cookies to help us to deliver our services. Please read our Privacy Policy.

Fi911

JULY 19, 2024

It includes fraudulent transactions, account takeover, and identity theft. It includes fraudulent transactions, account takeover, and identity theft. This can include invalid or missing authorization, non-compliance with processing rules, and delayed or erroneous authorizations. Incorrect Account Number 12.5:

PYMNTS

JUNE 25, 2018

Cybercriminals have a new favorite weapon in their quest to allude regulators, law enforcement and corporate security departments: account takeovers. Recent research reveals account takeovers have risen by 300 percent over the past year, with losses topping $5 billion. The Rise Of Account Takeovers.

PYMNTS

JANUARY 24, 2019

In many cases, Yu told Webster, the fraud situation is “much worse than before,” especially when it comes to ID theft and account takeovers. After the card [issued establishes] baselines to prevent account takeovers, that’s actually easier” than preventing fraud during the application phase, Yu said. Fraud Getting Worse.

PYMNTS

NOVEMBER 17, 2020

During this hectic time of year, merchants are particularly vulnerable to promotion abuse, account takeover and transaction fraud. Merchants can further up their game by tapping into advanced fraud tools that enable [them] to investigate suspicious activity, create custom rules using complex logic and pass custom fields.”.

PYMNTS

SEPTEMBER 24, 2018

There is seemingly no rule, rhyme or reason as to when a cyberattack will strike, or whom or what it will target, which can be particularly frightening. Fraudsters also use customers’ or executives’ lack of knowledge about security protocols to their advantage, and that’s where account takeovers come in.

PYMNTS

FEBRUARY 18, 2020

This opens the door to new avenues of attack by those who wish to steal data, hijack accounts and make off with ill-gotten gains, as Eric Kraus, vice president of risk, fraud and compliance at FIS , told PYMNTS in a recent interview. Proactive Fraud Prevention. Such transparency can foster brand loyalty, Kraus noted.

PYMNTS

MAY 20, 2020

As bad guys wrangle account details, cobble together synthetic identities and conduct account takeover attacks with ferocity, the old rules-based systems, password challenges and other lines of defense provide only part of the picture as to whether “good” customers are buying or “bad” actors are, well, getting away with it.

PYMNTS

SEPTEMBER 17, 2020

Sharing economy businesses looking to keep their guests safe must deter data breaches that continually threaten organizations and can allow cybercriminals to steal usernames and passwords to access accounts. Other account takeover (ATO) schemes involve bots, which can conduct some 100 hits per second.

PYMNTS

OCTOBER 3, 2019

Account takeover (ATO) fraud proved to be particularly effective, causing $4 billion in losses. Another potential benefit is association rules , which not only understand commonalities among uncategorized data but also find commonalities outside the data parameters. Fraud losses hit $14.7

PYMNTS

JANUARY 10, 2017

There are many other firms that do not count chargebacks as their main problems with fraud, instead, he noted, working against account takeovers. Think of email spam filters of old that were rules-based, he said, and inefficient, as those rules were rigid, poised to capture, for example, emails with the word “Viagra” in them.

PYMNTS

APRIL 24, 2020

Incidences of account takeover (ATO) were up 347 percent and shipping fraud skyrocketed 391 percent, respectively, from 2018 to 2019, before anyone except virologists had ever heard of COVID-19. But isn’t it just like hackers to exploit a terrible situation?

The Fintech Times

FEBRUARY 26, 2024

This is a new battleground with different rules of engagement. Research shows that the top six challenger and neobanks accounted for approximately 24 per cent of the global banking market in 2022, with forecast CAGR of 28 per cent through 2028.

Finovate

OCTOBER 24, 2024

Socure will use Effectiv to create complex, combinatorial rules that apply not only to its own solutions but also to those from third parties. Using Effectiv’s technology, firms can combat identity theft, account takeover, scams, and real-time payment fraud.

Fintech Finance

AUGUST 19, 2024

Unit21’s new ACH fraud solution proactively stops risky ACH transactions such as first-party fraud, account takeovers and scams by predicting fraudulent activity using four key features: ACH Risk Scoring – Unit21 deploys an ML model for FIs and fintechs that can flag R10s.

PYMNTS

JULY 10, 2020

We have deep dives into global fruit supply chain technology, account takeovers (ATOs), and news on stimulus checks. PYMNTS explores how the industry’s specific payment requirements necessitate the use of business management as well as accounts payable (AP) software designed for the space. Mitch McConnell , the U.S.

PYMNTS

JULY 21, 2020

In the latest Merchants Guide To Navigating Global Payment Regulations, Arregui discusses how merchants can best adjust to open banking rules and tailor their offerings to meet the needs of a mobile-first, unbanked customer base. Fraudsters are teaming up to form elaborate rings that work in sync to launch account takeovers.

PYMNTS

OCTOBER 29, 2018

These pieces of legislation introduced new rules about how companies and entities address issues of accountability, documentation, privacy reviews and design, and also impose high fines for non-compliance. Digital fraudsters could target data as it’s being transmitted by APIs.

PYMNTS

JANUARY 11, 2021

The great digital shift – and the rising tide of eCommerce – has placed greater pressure on companies to verify their customers and guard against account takeovers. In terms of mechanics, management said that retailers would work with Kount to develop specific transaction rules tied to their businesses.

PYMNTS

JANUARY 24, 2020

Knowledge-based authentication (KBA) measures such as security questions are not enough as synthetic IDs and account takeovers (ATOs) can often evade issuers’ defenses, Fox said. More flexible, insightful approaches are needed to round out defenses.

Seon

JUNE 15, 2023

A BEC attack is when a fraudster gains unauthorized access to a business’s account. The most damaging form of BEC is account takeover (ATO) attacks. Ask an Expert CEO Fraud CEO fraud is a catch-all term for the exploitation of the account of a high-ranking organizational official, such as a CEO or an investor.

FICO

JULY 30, 2019

Early telecom fraud warning alerts have traditionally been deployed by rules-based systems, which are effective to a point. However, with the ever-changing nature of fraud, dependency on rules introduces a latency in deployment, and it can be difficult to manage rulesets that may quickly become obsolete.

PYMNTS

AUGUST 12, 2016

Too bad, said Apple, who yesterday fired back with an assertion that providing access to the NFC antenna would “fundamentally diminish the high level of security that Apple maintains on its devices,” turning a blind eye just for the moment to the account takeover issues that have plagued Apple since launch.

PYMNTS

SEPTEMBER 24, 2020

Those lines of defense can indeed be effective, said Donlea, “as long as details in that consumer's account have not already been changed through an account takeover.”. Traditional wallets in the APAC region market have relied on two-factor authentication or one-time passwords.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content