Why AI’s Early Adopters Are Laser-Focused On Credit Risk And Payments

PYMNTS

APRIL 24, 2020

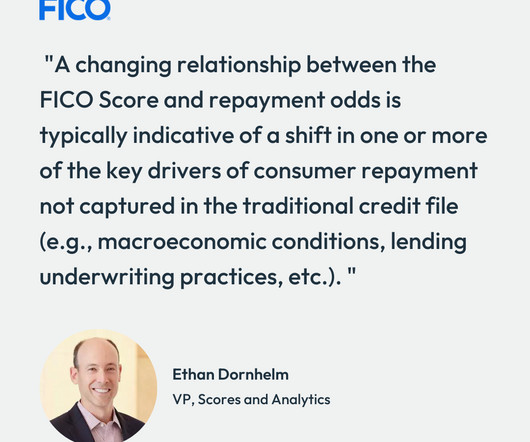

These circumstances have brought to the fore what has long been a central concern for lenders: assessing and managing credit risk. PYMNTS’ latest research reveals that this is changing, however: The share of financial institutions (FIs) using AI has increased dramatically since 2018. percent employ it for credit underwriting.

Let's personalize your content