What Is a Clearinghouse and How Does It Facilitate Safe Transactions?

EBizCharge

DECEMBER 18, 2024

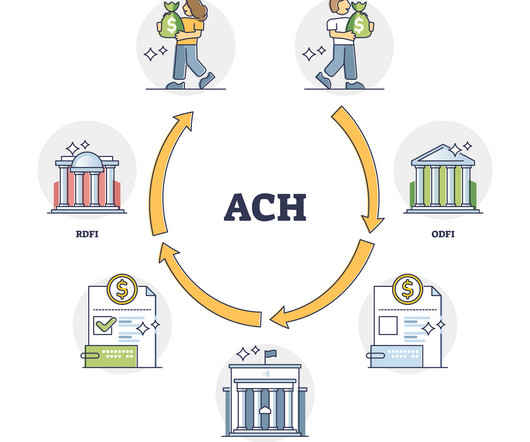

Verification and validation Clearinghouses confirm the authenticity of all parties involved in a transaction through verification and validation. Payment clearinghouses consist of: Automated clearinghouse (ACH): Handles electronic payments such as direct deposits, bill payments, and money transfers.

Let's personalize your content