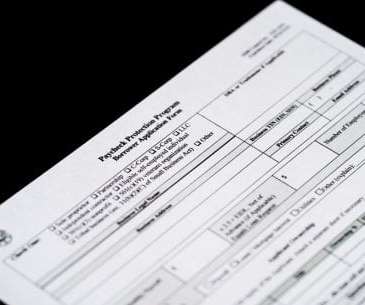

Wells Fargo Shifts Gears To Extend Small Business $10B In Relief Loans

PYMNTS

APRIL 6, 2020

It anticipates that its loan capacity will be maxed out under the program since it is operating with the current asset cap limitations. Today, the company continues to operate in compliance with an asset cap imposed by its regulator due to actions of past leadership. Customers will be notified with updates in the coming days.

Let's personalize your content