What Does the End of the CFPB Mean for Credit Risk Innovation?

The Fintech Times

JULY 1, 2025

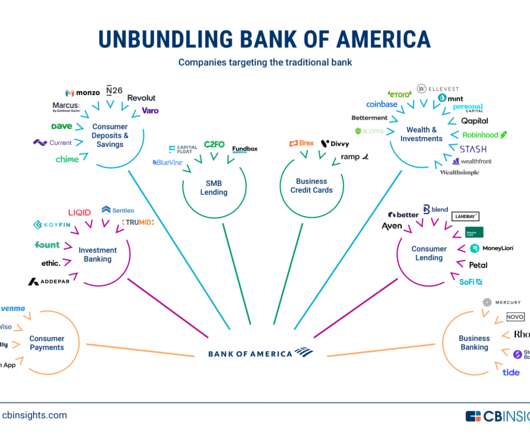

Michele Tucci, chief strategy officer and co-founder of Credolab, a global device behavioural data and analytics company, looks at how the current regulatory rollback could open the door for lenders to rethink credit scoring and explore new ways to widen access. That’s key in a market where consumer trust remains fragile.

Let's personalize your content