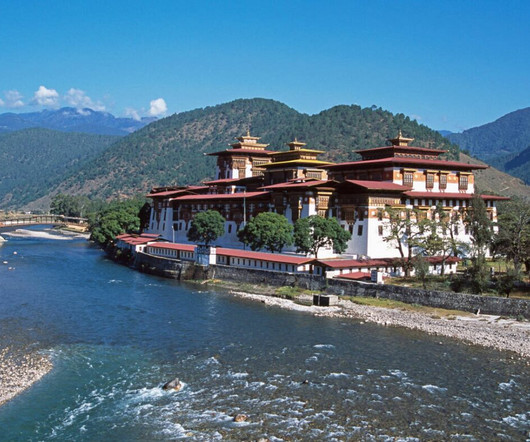

Tradition and Technology: Bhutan’s Journey into Fintech and Financial Inclusion

The Fintech Times

NOVEMBER 2, 2024

Ltd : Developed an ‘e-KYC’ solution to digitally onboard customers, using advanced technologies like artificial intelligence, machine learning, thumbprint and facial recognition for a streamlined digital KYC platform Soft Net Technology : Proposed a centralised loan application platform in response to pre- and post-Covid challenges.

Let's personalize your content