APAC Sees 23% Decline in Crypto Fraud

Fintech News

MARCH 24, 2025

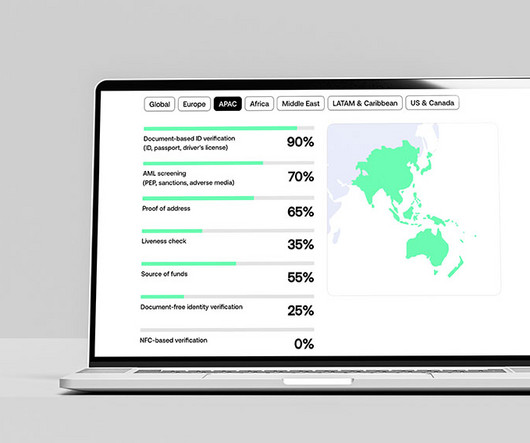

The report, based on Sumsubs internal identity verification and user activity data from 2023 and 2024, along with a survey of over 300 companies across the crypto, banking, payments, and e-commerce sectors, reveals that APAC was the only region to record a decline in crypto fraud in 2024, with fraud rates dropping from 2.6%

Let's personalize your content