Fed study highlights growth in card, ACH payments

Payments Dive

APRIL 24, 2023

Card, ACH and check payment values climbed from 2018 to 2021, as cash was left behind, according to the Federal Reserve’s noncash payments study.

Payments Dive

APRIL 24, 2023

Card, ACH and check payment values climbed from 2018 to 2021, as cash was left behind, according to the Federal Reserve’s noncash payments study.

The Paypers

APRIL 26, 2023

Germany-based insurtech company Baobab has received funding from the Investitionsbank Berlin, which is co-financed by EU funds (ERDF).

CB Insights

APRIL 28, 2023

Shopify, an e-commerce infrastructure leader, has long used business partnerships to help merchants with handling payments. The company is continuing this strategy with its new partnership with invoice payments platform Melio to offer a direct bill payments service — which includes an option to pay directly through a bank account. This reflects a broader trend: Account-to-account (A2A) payments , where funds are transferred between two bank accounts without intermediaries such as card netw

Open Banking

APRIL 28, 2023

Earlier this week, OBL hosted a Parliamentary reception with regulators, MPs, civil servants and members of the open banking ecosystem, with a panel discussion on the future of open banking, open finance and Smart Data. Following last week’s publication of the Joint Regulatory Oversight Committee’s Report on the future of open banking, and ahead of the inaugural meeting of the newly formed Smart Data Council , it was a timely opportunity to explore the next steps needed to build on the success o

Speaker: Jason Cottrell and Gireesh Sahukar

Retailers know the clock is ticking–legacy SAP Commerce support ends in 2026. Legacy platforms are becoming a liability burdened by complexity, rigidity, and mounting operational costs. But modernization isn’t just about swapping out systems, it’s about preparing for a future shaped by real-time interactions, AI powered buying assistants, and flexible commerce architecture.

Payments Dive

APRIL 25, 2023

Fiserv bested FIS in the competitive payments processing market last year, handling more transactions with a larger value, said an industry consultant.

The Paypers

APRIL 28, 2023

Cloud-based tax compliance automation provider Avalara has announced a partnership with eBay to address cross-border compliance for global sellers.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Axway

APRIL 27, 2023

Consider this scenario: Using your ID and password, a third party logs into your online bank account as if they are you. The information retrieved is then funneled into, for example, a budgeting app.

Payments Dive

APRIL 28, 2023

The Justice Department’s antitrust division issued a civil investigative demand to the card company as part of a debit card probe that has also entangled its larger rival Visa.

The Paypers

APRIL 26, 2023

Canada-based fintech Nuvei has integrated with Sabre Corporation to strengthen its payments capabilities and expedite its travel and hospitality partners’ growth.

Core

APRIL 26, 2023

For decades, government agencies and departments have structured their billing and payment processes through the identification of their citizens. In the latest Government Roundtable Series webinar, CORE’s SVP of Development—Alan Pyrz, VP Head of Government Sales—Justin Dillon, and VP of Marketing—Shash Cates unpack how revenue systems can also be structured through property.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Stripe

APRIL 26, 2023

Integrating and upgrading to the Payment Element is now easier than ever with server-side confirmation and a new integration path that lets you collect payment details before creating a PaymentIntent or SetupIntent.

Payments Dive

APRIL 26, 2023

The mega processor has a handful of bank customers in the Federal Reserve’s real-time payments pilot, and a pack signed up for services after the system’s July launch. It’s part of the company’s growth strategy.

The Paypers

APRIL 28, 2023

US-based Plug and Play has revealed that it will expand the Crypto and Digital Assets programme to France to help businesses move from Web2 to Web3.

Axway

APRIL 26, 2023

Axway turns PSD2 from compliance to acceleration by moving a vision of PSD2 (and soon, PSD3) fulfillment to the concept of open banking. Keep in mind that PSD2 covers only the payment part of the bank.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Stripe

APRIL 26, 2023

Businesses can now accept more buy now, pay later methods globally through one integration on Stripe: Klarna in AU, NZ, CA, CH, PT, PL, CZ, and GR; Affirm in CA.

Payments Dive

APRIL 24, 2023

Explaining three reasons why declined transactions are turning customers on to Buy Now Pay Later services for a friendlier purchasing process.

The Paypers

APRIL 24, 2023

Fintech provider Bottomline has announced the technical integration of its user monitoring solution Record & Replay with threat detection and response platform Trellix XDR.

Nanonets

APRIL 26, 2023

PDF → Excel Convert PDF bank statements to Excel Try for Free In today's fast-paced business world, faster loan approvals and lending processes are a key goal both for lenders and people applying for loans. Lenders are therefore constantly seeking ways to improve their processes and increase efficiency. Automation can have a significant impact on this process—particularly the loan underwriting process.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Axway

APRIL 26, 2023

Groupe BPCE , one of France’s largest banking groups, stands at the center of a dynamic open banking ecosystem powered by APIs. Headquartered in Paris, the group’s 105,000 employees deliver a comprehensive range of banking and insurance services.

Payments Dive

APRIL 25, 2023

The technology that allows a contactless payment using a customer’s palm is being tested at the first stand-alone convenience stores.

The Paypers

APRIL 27, 2023

The US Department of the Treasury has revealed the 2023 De-Risking Strategy, which examines the phenomenon of financial institutions de-risking.

FICO

APRIL 26, 2023

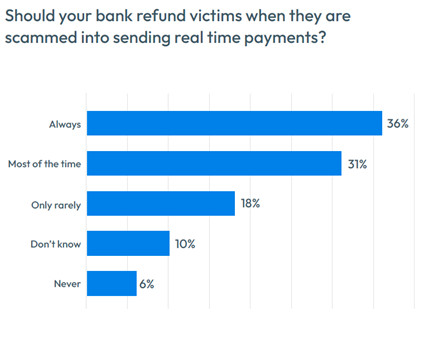

Home Blog FICO Survey: Do Customers Think Banks Are Fair to Scam Victims? Banks face challenges when it comes to balancing the ease and convenience of real-time payments with prevention for authorized push payment fraud and scams FICO Admin Tue, 07/02/2019 - 05:23 by Debbie Cobb Senior Director, Product Management expand_less Back To Top Wed, 04/26/2023 - 11:00 Scams have been on the rise worldwide, particularly those that target real-time payments (RTP) users.

Speaker: Benjamin Woll, Tiffany Spizzo, and Jaime Santos Alcón

Enterprise commerce is at an inflection point. Rigid, monolithic platforms slow brands down, but a full replatforming is disruptive and costly. Modular architecture offers a flexible, scalable alternative - allowing enterprise brands to modernize without ripping and replacing their entire stack. Learn how a composable approach helps modernize commerce stacks while maintaining control over critical systems.

BitPay

APRIL 25, 2023

Stablecoins help bridge the gap between fiat currency and crypto. Businesses can quickly move money without crypto’s usual price volatility, while still conducting secure, low-cost financial transactions without centralized intermediaries like governments or banks. Ahead we’ll take a closer look at what makes stablecoins a leading option for cross-border crypto payments.

Payments Dive

APRIL 28, 2023

The card network company is considering using artificial intelligence in more ways, including in customer service, CEO Michael Miebach said.

The Paypers

APRIL 24, 2023

Singapore-based Bisonai has partnered with Polygon Supernet to offer a scalable and customisable Web3 infrastructure to businesses.

Axway

APRIL 25, 2023

The challenge of providing personalized, integrated, real-time experiences for consumers has naturally led businesses to rely on a growing ecosystem of applications and services; no single organization can accomplish this alone, and new technologies require new integrations.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

BitPay

APRIL 25, 2023

Cryptocurrency is well established as an investable asset and global payments method, but its long-term value proposition to businesses goes far beyond these use cases. As the digital assets landscape evolves, companies of all sizes are integrating cryptocurrency into their business models to make key processes like employee payroll faster, cheaper and more efficient.

Payments Dive

APRIL 27, 2023

Attorneys and payments professionals called out recent areas of interest for regulators during the Electronic Transactions Association’s conference this week in Atlanta.

The Paypers

APRIL 26, 2023

US-based customer data platform Klaviyo has integrated with Square Online, Square ’s ecommerce platform, to deliver more personalised customer experiences.

Axway

APRIL 25, 2023

The challenge of providing personalized, integrated, real-time experiences for consumers has naturally led businesses to rely on a growing ecosystem of applications and services; no single organization can accomplish this alone, and new technologies require new integrations.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Let's personalize your content