MoneyGram dives deeper into crypto

Payments Dive

NOVEMBER 2, 2022

The money transfer company said it’s adding a new crypto feature to its mobile app, expanding on an attempt to appeal to a younger client set.

Payments Dive

NOVEMBER 2, 2022

The money transfer company said it’s adding a new crypto feature to its mobile app, expanding on an attempt to appeal to a younger client set.

The Paypers

NOVEMBER 4, 2022

Lithuania-based fintech Paysera has partnered with Airwallex to enable its clients to send money to 149 countries and 9 countries’ open IBAN accounts.

CB Insights

NOVEMBER 3, 2022

While insurtech funding has remained relatively flat quarter-over-quarter in 2022, insurers are still actively engaging with startups to improve their businesses — including addressing climate-related risks. . download the State of Fintech Q3 ’22 Report. Get the free report for analysis on dealmaking, funding, and exits by private market fintech companies.

Axway

OCTOBER 31, 2022

“API Products” are mentioned relatively often, and there are different ways to look at the topic. None of them is inherently “right” or “wrong”, and we’ll discuss the two most important flavors of API products in this blog post.

Speaker: Jason Cottrell and Gireesh Sahukar

Retailers know the clock is ticking–legacy SAP Commerce support ends in 2026. Legacy platforms are becoming a liability burdened by complexity, rigidity, and mounting operational costs. But modernization isn’t just about swapping out systems, it’s about preparing for a future shaped by real-time interactions, AI powered buying assistants, and flexible commerce architecture.

Payments Dive

NOVEMBER 3, 2022

The payments company will cut about 1,140 jobs as it reins in expenses in the face of deteriorating economic conditions after growing too fast.

The Paypers

NOVEMBER 1, 2022

Rapyd has conducted a fintech developer survey that reveals their challenges, opportunities, and a wish to collaborate within the developer community.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Axway

NOVEMBER 3, 2022

Most entrepreneurs will agree that the best ideas are born out of a genuine need to solve a problem.

Payments Dive

NOVEMBER 3, 2022

With the latest acquisition, Fiserv is further strengthening its restaurant chops, adding cloud-based reservation and table management to its BentoBox operation.

The Paypers

NOVEMBER 3, 2022

Twilio has announced the update of their Customer Engagement Platform with capabilities for strengthening digital businesses’ customer relationships.

CB Insights

NOVEMBER 3, 2022

Fintech funding stumbled in Q3’22 , falling 38% quarter-over-quarter to $12.9B. Banking startups were also hit hard, with dollars invested falling to the lowest level since 2018. But even with financing becoming tighter, technologies are still emerging that could shake up the industry. download the State of Fintech Q3 ’22 Report. Get the free report for analysis on dealmaking, funding, and exits by private market fintech companies.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Open Banking

NOVEMBER 3, 2022

It’s an exciting time for open banking as the government and regulators, through the Joint Regulatory Oversight Committee (JROC), decide the next phase for open banking following the completion of the roadmap implementation. We’re very fortunate in the UK to have benefited from a competition-focused regulatory environment which has delivered a vibrant open banking ecosystem that is now being exported to around 80 countries across the world.

Payments Dive

OCTOBER 31, 2022

Sen. Elizabeth Warren told the Consumer Financial Protection Bureau that it should amend Regulation E of the Electronic Fund Transfer Act “to increase consumer protection.

The Paypers

NOVEMBER 2, 2022

Standard Chartered has announced on the first day of Singapore Fintech Festival the launch of Payouts-as-a-Service (PaaS), a bank-grade fintech solution that allows digital businesses to manage one-to-many payments to parties in their ecosystem.

CB Insights

OCTOBER 31, 2022

The investment landscape has changed dramatically in the last decade with the rise of retail investment platforms allowing individuals to control their own portfolios. These apps offer consumers a cheaper, faster, and more hands-on experience — and completely bypass institutional investors. download the State of Fintech Q3 ’22 Report. Get the free report for analysis on dealmaking, funding, and exits by private market fintech companies.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

FICO

NOVEMBER 3, 2022

Home. Blog. FICO. Debt Collection: Have We Learned the Lessons of the Last Crises? While the current series of economic shocks may seem "unprecedented", there are clear lessons from past crises that should shape our collections strategies today. FICO Admin. Tue, 07/02/2019 - 02:45. by Bruce Curry. Senior Principal Consultant. expand_less Back To Top.

Payments Dive

NOVEMBER 4, 2022

The digital payments company plans to slow the pace of hiring in 2023 as executives aim to rein in expenses.

The Paypers

NOVEMBER 3, 2022

The Paypers has launched the 6th edition of the Open Banking Report , which uncovers the global potential of Open Banking, Open Finance, and Open Data.

CB Insights

NOVEMBER 4, 2022

The future of investing will be built around key technologies such as: Alternative investing platforms that open access to non-traditional assets like private equity, real estate, art, and crypto for retail investors and their advisors. ESG powered by AI that gives retail and institutional investors more complete and accurate assessments of investments’ environmental and social impacts.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Axway

NOVEMBER 2, 2022

Open Banking platforms grew worldwide at 381% in 2020 and Brazil was eager to embrace the wave of innovation.

Payments Dive

OCTOBER 31, 2022

The company better known for paper checks is preparing for increased consumer use of digital assets, with plans to add options for accepting crypto next year.

The Paypers

NOVEMBER 2, 2022

PayMate has incorporated and registered its entities in Singapore and Sri Lanka to offer its B2B payments platform, to help customers’ working capital needs.

FICO

NOVEMBER 2, 2022

Home. Blog. FICO. The Rise of Telco Cloud-Based Platform Solutions. As telcos make the transition from on-premises to cloud-based platform solutions, they need to get maximum value from the data sets, information sources and insights available. FICO Admin. Tue, 07/02/2019 - 02:45. by Tim Young. expand_less Back To Top. Wed, 11/02/2022 - 13:35. Many prevailing industry operating models are one to two generations behind the current available telco cloud-based technology.

Speaker: Benjamin Woll, Tiffany Spizzo, and Jaime Santos Alcón

Enterprise commerce is at an inflection point. Rigid, monolithic platforms slow brands down, but a full replatforming is disruptive and costly. Modular architecture offers a flexible, scalable alternative - allowing enterprise brands to modernize without ripping and replacing their entire stack. Learn how a composable approach helps modernize commerce stacks while maintaining control over critical systems.

Cardfellow

OCTOBER 31, 2022

They may have even suggested a specific gateway, such as Authorize.Net or NMI. Or perhaps you’re currently using one of those gateways but are considering a switch. In this article, we’ll compare and contrast Authorize.Net and NMI, two of the most popular gateways available, to help you make the right decision. Key Terms About Authorize.Net About NMI Key Differences Between Authorize.Net and NMI Features and Services Authorize.Net Features NMI Features Pricing Key Terms In order to effectively c

Payments Dive

OCTOBER 31, 2022

The company is bringing the peer-to-peer payments tool to community and regional bank clients, after big banks made P2P popular through Zelle.

The Paypers

NOVEMBER 1, 2022

Estonia-based core banking platform Tuum has partnered with SaaS provider Bricknode to augment FIs in deploying digital investment products.

FICO

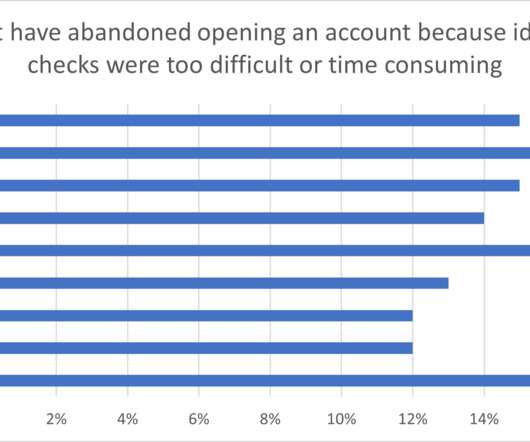

NOVEMBER 1, 2022

Home. Blog. FICO. Application Fraud – Does Canada Need a New Approach? FICO’s Fraud, Identity and Digital Banking Survey 2022 shows that customers in Canada want slick onboarding processes, where fraud controls work but don’t delay account opening. FICO Admin. Tue, 07/02/2019 - 02:45. by Fernando Lopez. expand_less Back To Top. Tue, 11/01/2022 - 10:40.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

CB Insights

OCTOBER 31, 2022

Global funding to blockchain and crypto startups fell by 35% quarter-over-quarter in Q3’22, as venture capital investors remained cautious amid the continued crypto winter, rising inflation, and the Fed’s interest rate hikes. . Below, take a look at a few highlights from our 141-page, data-driven State of Blockchain Q3’22 Report. For deeper insights and all the private market data, download the full report. download The State of Blockchain q3’22 report.

Payments Dive

NOVEMBER 4, 2022

The special grant to American Express CEO Steve Squeri reflects “his outstanding leadership” at the company, Amex said in a regulatory filing.

The Paypers

OCTOBER 31, 2022

Fintech Nets has published its Nordic Payment Report 2022 , revealing that mobile payments are the preferred payment method at physical points of sale.

Payments Dive

NOVEMBER 3, 2022

Twitter’s new billionaire owner plans to make the company into a payments player, but industry pros say social media platforms aren’t cut out for that game.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Let's personalize your content