Decoding the FCA’s Safeguarding reforms: Practical steps for payments and E-money firms

The Payments Association

JANUARY 13, 2025

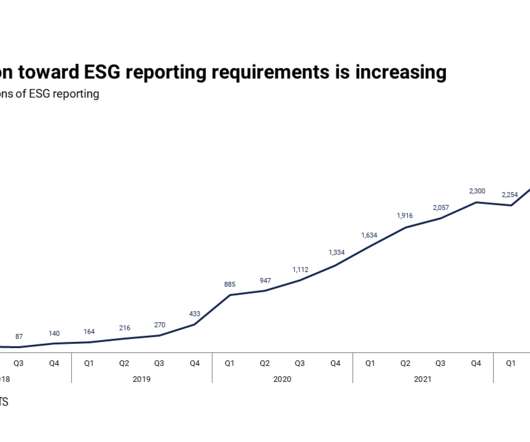

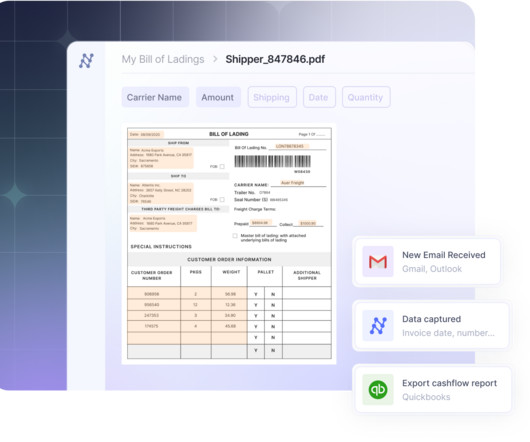

Smaller firms, for example, are likely to bear the brunt of financial pressures introduced by the reforms with hiked compliance costs that come with implementation of new safeguarding workflows, engaging with auditors and fulfilling enhanced reporting requirements.

Let's personalize your content