The state of fraud in 2024: Key mid-year takeaways

The Payments Association

OCTOBER 28, 2024

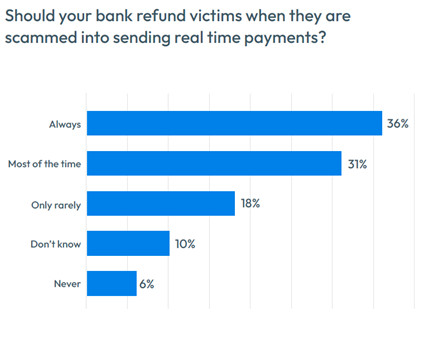

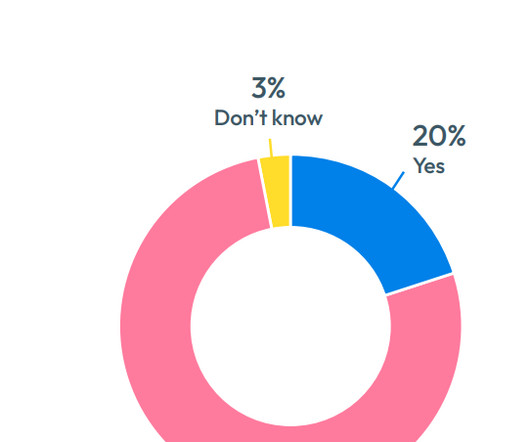

From shifts in unauthorised card fraud to the evolving nature of authorised push payment scams, there’s a lot to unpack—and a lot at stake. This has led to a noticeable uptick in card-related fraud, especially in remote purchases, where criminals use stolen card details for online transactions. What’s next?

Let's personalize your content