The Full List of Fintech Unicorns in Asia (2025)

Fintech News

APRIL 24, 2025

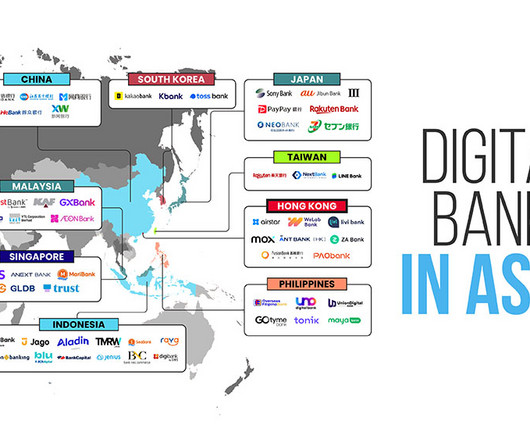

The city is home to four fintech unicorns in Asia: HashKey Group, WeLab, Micro Connect, and ZA Group, each pushing the boundaries of digital finance in unique ways. The fintech unicorns in Asia are moving to reshape the very fabric of how people and businesses interact with money. billion insurtech Matrixport 1.05 billion payments Coda 2.5

Let's personalize your content