PayPal sets the pace for the payments industry in 2018

Payments Dive

JANUARY 2, 2018

For a company once known as a threat to the card networks and banks, PayPal is now an ally as it pushes forward with digital payments.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

JANUARY 2, 2018

For a company once known as a threat to the card networks and banks, PayPal is now an ally as it pushes forward with digital payments.

Fintech News

APRIL 24, 2025

The city is home to four fintech unicorns in Asia: HashKey Group, WeLab, Micro Connect, and ZA Group, each pushing the boundaries of digital finance in unique ways. The fintech unicorns in Asia are moving to reshape the very fabric of how people and businesses interact with money. billion insurtech Matrixport 1.05 billion payments Coda 2.5

PYMNTS

DECEMBER 19, 2018

With the launch of Ingo Money QuickConnect last week , the company capped off a year that CEO Drew Edwards told Karen Webster could best be characterized as the “Great Awakening” of push payments. We’ve finally moved beyond ‘so what is a push payment?’ That one bite is via a card that almost everyone has in their wallets today.

PYMNTS

OCTOBER 27, 2020

The acquisition builds on a strategic partnership and investment made in 2018, where Visa invested in the company back then. YellowPepper will help integrate more easily with Visa Direct, Visa's real-time push payments platform, Visa B2B Connect, its non-card-based B2B network and value-added services.

The Payments Association

DECEMBER 11, 2024

In relation to safeguarding , the FCA is rightly concerned that for firms that became insolvent between Q1 2018 and Q2 2023, there was an average shortfall of 65% in funds owed to clients (i.e. It highlights the need for a strategic, proportionate approach to safeguarding that aligns with broader regulatory and consumer protection goals.

PYMNTS

FEBRUARY 4, 2019

percent in Q2 2018 to as much as 41.2 percent in Q3 2018. In the Q3 2018 edition of the Financial Invisibles Report , PYMNTS surveyed more than 2,000 American consumers to get to the bottom of what was driving their financial confidence — even in the face of delinquency. The usage of credit cards to pay off debt shot up from 44.6

PYMNTS

DECEMBER 27, 2018

However, an awful lot is in fact different at the dusk of 2018 than it was at the dawn. The year 2018 saw massive changes in where consumers shop, how they pay, and what goods and services they want in their carts. Yet, as 2018 was coming to a close, Facebook was hit with just a bit more bad news. The Facebook Follies.

PYMNTS

JANUARY 4, 2018

Another year, another chance for mobile wallet players to convince consumers to give up their plastic cards and utilize the phone as a payments form factor. More than 40 percent of respondents — as of September 2017 — noted that they liked their cards just fine. It hasn’t been easy. The most-used mobile wallet in the U.S.

Fintech News

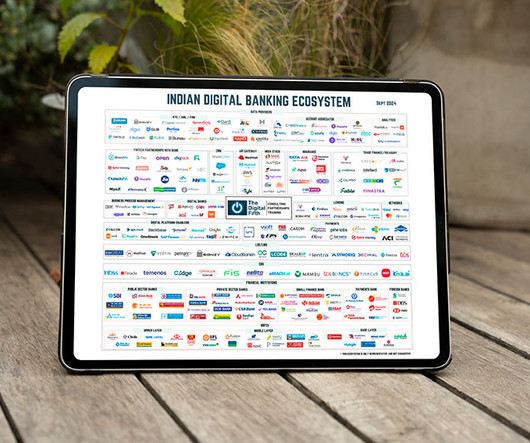

OCTOBER 10, 2024

Banks push for digitalization According to the report, large banks are at the forefront of the sector’s digital transformation. This dynamic ecosystem is supported by regulatory advancements and collaborative partnerships, which are expected to continue fostering innovation and growth in the sector.

Fintech News

APRIL 13, 2025

The firm raised USD $334 million in 2024 from investors including MUFG and Sumitomo Mitsui, pushing its total funding above USD $1.13 CRED USD $867 Million CRED burst onto the scene in 2018 with a bold missionto reward Indias most creditworthy consumers. They can either have reached unicorn status or not. billion prior to its IPO.

CB Insights

DECEMBER 4, 2019

While the anticipation for Amazon’s plunge into banking gets louder each year, it’s important to first understand Amazon’s existing strategy in financial services — what Amazon has launched and built, where the company is investing, and what recent products tell us about Amazon’s future ambitions. Amazon Payments.

PYMNTS

JULY 16, 2018

He says the uptick is caused, in part, by the sales lasting 36 hours this year and because of the discounts Amazon is pushing, particularly on its own in-house line of electronic products. and around the world, Prime Day 2018 could be a very busy one for the most popular voice-activated AI system in America.

PYMNTS

FEBRUARY 19, 2018

In short, while 2017 was the year of payments disruption, 2018 will be the year of the satisfied customer. The newest PYMNTS eBook is full of expert insight into the future of B2B payments, from commercial cards to accounts receivable. trillion: the current valuation of the U.S. trillion: the current valuation of the U.S.

PYMNTS

DECEMBER 26, 2018

Don’t think of them as mere podcasts — though PYMNTS certainly does a lot of podcasts, discussing with payments and commerce experts the hottest topics of the day, with each conversation not only digging into the past and present but having an outlook toward the future. No, think of them as miniature seminars. The Rise of Contextual Commerce.

The Fintech Times

SEPTEMBER 14, 2024

Taiwan, along with South Korea, Hong Kong SAR, and Singapore, forms the group known as the ‘Four Asian Tigers,’ renowned for their rapid industrialisation since the 1960s. These economies have since developed into fully advanced nations. Taiwan’s gross domestic product (GDP) per capita is over $35,000.

PYMNTS

NOVEMBER 15, 2017

Patent and Trademark Office, shows Mastercard ’s plans to deploy distributed ledger technology to develop a platform on which credit card transactions can be completed in real-time, rather than through the current system, in which payees have to wait several days before those transactions are verified and land in their accounts. Mastercard.

PYMNTS

FEBRUARY 26, 2020

However, those trend lines soon gave way to growth in the early 2010s and beyond — driven by the digitization of commerce — with the card network’s revenue tripling in the last decade. He has served as Mastercard’s Chief Product Officer since 2016 and has headed the network’s new products and innovation team since 2018.

PYMNTS

NOVEMBER 21, 2018

The paper reported that Amazon in its initial push and has been working with gas stations, restaurants and local merchants that aren’t competing directly with Amazon. Amazon’s push into digital payments comes at a time when U.S. The paper noted it is not clear how customers will use Amazon Pay in physical stores.

Tearsheet

MARCH 13, 2025

Last year, Brex born as a scrappy startup with a corporate card for startups that transformed into a global fintech and enterprise SaaS firm in corporate spend made a bold move: it hit reset. This move simultaneously positioned Brex as a competitor to companies like Ramp and traditional corporate card providers.

PYMNTS

APRIL 30, 2020

Treasury will allow two financial technology companies to issue prepaid Visa cards loaded with coronavirus stimulus payments. Treasury Secretary Steven Mnuchin had said a more efficient distribution of government funds would be achieved through digital delivery and prepaid card providers. So far, the agency has delivered 89.5

PYMNTS

AUGUST 6, 2020

trillion in 2018. are made with cash , for example, and 63 percent of consumers have at least two credit cards. Deep Dive: Why Banks Are Pushing To Modernize Their Payments Infrastructures. Banks are pushing harder than ever toward faster, seamless payments, and numerous factors are fueling this drive toward innovation.

PYMNTS

MAY 10, 2017

These two offers — a tokenized network card provisioning and card-on-file APIs — will soon allow Visa issuers to power a customizable suite of digital account control services within their native mobile banking apps. Solutions exist currently, of course.

PYMNTS

SEPTEMBER 3, 2018

Since we would hate for anyone to go into the end of 2018 behind the eight ball, we decided to pay tribute to both a great bit and a great deal of news with our own top 10 list of the biggest news of summer 2018. It is not an exaggeration to say that 2018 has been the summer of movie subscription service MoviePass ’ discontent.

PYMNTS

DECEMBER 8, 2016

gas station owners to install EMV chip card readers at the pump. One point of comfort might rest with the fact that Visa has said that fraud rates at the pump are low in comparison to almost all other points of card activity, comprising about 1.3 Earlier this month, Visa and Mastercard said they had extended the deadline for U.S.

Open Banking Excellence

SEPTEMBER 5, 2023

Since Open Banking launched on January 18, 2018, banks have made a suite of mandatory APIs available to TPPs. Our first reaction to observing this opportunity was to consider if and how we could persuade the regulator to push banks to make more APIs available. NatWest has been working to solve this puzzle for several years.

PYMNTS

DECEMBER 17, 2020

Account takeovers and shipping fraud increased by 347 percent and 391 percent, respectively, between 2018 and 2019, and the pandemic has only exacerbated these issues. Digital fraud is a long-running problem for merchants, retailers, banks and businesses of all types. Walgreens On Stopping Promotion Abuse Fraud Through Online Deals.

PYMNTS

NOVEMBER 6, 2018

American Express has struck a new partnership in its latest B2B payments push, announcing a collaboration with commercial payments firm WEX to support corporate use of virtual cards in accounts payable. In an announcement on Monday (Nov.

PYMNTS

JANUARY 1, 2019

Here’s a 2019 prediction that we guarantee will come true: There will be no human being or business adamantly hoping to be paid slower in 2019 than they were in 2018. When PYMNTS and Visa spoke to 2,800 consumers for the 2018 edition of the How We Will Pay study, working consumers were among the groups keenest to be paid faster.

PYMNTS

OCTOBER 14, 2020

Payguru is a Turkish company currently working to give residents a way to pay for bus travel cards via text message, according to a report by Financial Times (FT). The way it works, since the company began testing it in the city of Kahramanmaras in 2018, is that users can send a text message and refill their cards via mobile phone.

PYMNTS

JULY 4, 2018

February’s announcement that Visa would acquire long-time expense management partner Fraedom was the latest in a string of B2B payments initiatives for the credit card company. Last May, the company explored how its Mastercard Send solution, which began as a peer-to-peer (P2P) push payments tool, would break into the B2B market.

PYMNTS

MARCH 18, 2019

Connecting these two dots suggests a few important things that, for banks and card networks, might be the 2020 hindsight that could have come in handy had they stopped to look backwards a few years ago: That the Fed has much more than a passing interest in how faster payments are run in the U.S. A Couple of Important Dots.

CB Insights

FEBRUARY 13, 2020

As businesses and consumers become more comfortable using credit cards online, the proportion of US commerce that takes place online has steadily increased over the last 20 years. Virtual card issuance. Business lending and corporate cards. Supporting merchant partner growth. Growing the internet economy.

PYMNTS

NOVEMBER 20, 2020

Such factors could drive companies worldwide to seek the utility and flexibility of delivering payroll via prepaid cards, and this month’s Deep Dive examines companies’ growing interest in these tools. . Companies with global workforces need to overcome numerous challenges to quickly and easily pay their employees. Paying unbanked workers

FICO

MARCH 26, 2018

In February 2018 Australia launched their New Payments Platform for use by consumers. While e-wallets and person-to-person schemes offer people quick and easy ways to pay, they have been underpinned by pre-existing payment systems, either card schemes or ACH transfers. Authorised Push Payment Fraud at the Point of Transaction.

PYMNTS

AUGUST 23, 2019

In 2018, many teams switched to mobile ticketing, resulting in nearly 80 million mobile sports ticketing users. Between 2016 and 2018, the volume of orders placed through mobile apps grew by 130 percent, according to PYMNTS’ Mobile Order-Ahead Tracker. No industry is immune to digital transformation. Mobile Ticketing. Several U.S.

PYMNTS

APRIL 30, 2019

The agreement means both companies will work to improve “payment processing and enable push and pull transaction capabilities.” Cross River was founded in 2008, and in December of 2018, it secured $100 million in a funding round led by KKR. RS2 builds payment solutions for upwards of 14 million merchants.

PYMNTS

JULY 2, 2019

Powered by Visa Direct, Visa’s real-time push payments solution, (Instant Transfer) moves money from customers’ PayPal accounts to their bank account via their Visa debit cards — providing an experience that offers speed, security and convenience, 24/7/365,” according to statement describing the launch. Australia, Italy and Spain.

PYMNTS

NOVEMBER 1, 2018

The influx of freelancers is pushing companies to adopt even faster methods of disbursements to satisfy their need for payment speed. In the latest Disbursements Tracker , PYMNTS takes a look at the latest disbursements news and recent developments pushing us further from the paper check. Around The World Of Disbursements.

CB Insights

AUGUST 2, 2018

One of the biggest trends in fintech today is the rise of digital banking products like mobile checking accounts and new debit cards. From Square to Paypal, a host of fintechs are creating products that let consumers spend money directly out of digital accounts using a physical card. turning Digital p2p payments into debit cards.

PYMNTS

OCTOBER 12, 2018

per share in the third quarter of 2018, better than the $1.69 That pushed third-quarter profit up 21.8 The North American card business also saw strong yields, pushed by a host of promotional credit cards shifting out of their long “no APR period” to interest-generating vehicles. percent from 8.28

PYMNTS

DECEMBER 20, 2018

What’s more, Bloomberg said in 2012 it took three times longer to find a job when compared with 2018. LendingTree recently reported that based on holiday shopping and credit card spending, balances on credit cards will increase by around 5 percent through the end of the year. Student loan debt in the U.S. There were 1.8

PYMNTS

AUGUST 20, 2020

No single payment method will suit all needs, but many employers in Europe are finding it important to disburse freelancers’ funds onto payroll cards. No single payment method will suit all needs, but many employers in Europe are finding it important to disburse freelancers’ funds onto payroll cards.

PYMNTS

FEBRUARY 22, 2018

Hackers who used to amuse themselves stealing credit cards have raised the level of their identity theft game such that 2017 was a record year — 16.7 Al Pascual, Javelin’s research director and head of fraud and security, expects 2018 to be another record year. Who says you can’t teach an old criminal new tricks? They’re smarter now.

PYMNTS

JANUARY 22, 2021

In 2018 the Supreme Court struck down a 1984 federal law that prohibited gambling in most states. A problem compounded, he said, when in many cases those rules have requirements that successfully push players like Ingo out of the market and ultimately slow progress. There have been advances. Untangling Red Tape.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content