MAS Chief: Singapore Must Choose Security Over Convenience in Fight Against Scams

Fintech News

JULY 15, 2025

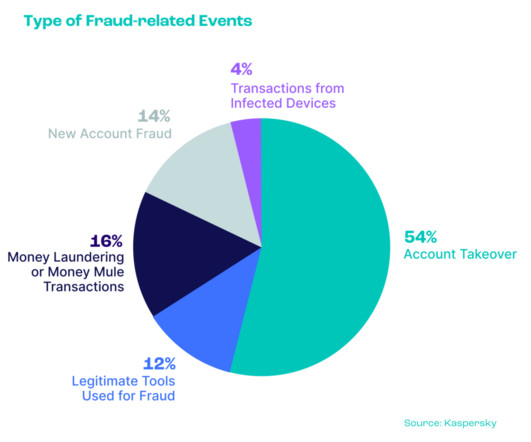

Singapore will need to prioritise security over convenience in the ongoing fight against financial scams, according to MAS Managing Director Chia Der Jiun. Over the past year, banks have phased out SMS one-time passwords (OTPs) for digital logins and card transactions, reducing the risk of account takeovers.

Let's personalize your content