Decoding the FCA’s Safeguarding reforms: Practical steps for payments and E-money firms

The Payments Association

JANUARY 13, 2025

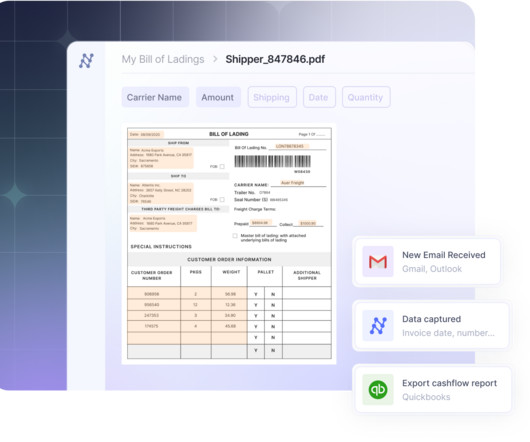

The reforms ensure robust safeguarding practices, bolster consumer trust, and address risks like fund shortfalls during insolvency. Central to these changes are new statutory trust requirements, more prescriptive record-keeping, reconciliation standards, and the mandate for external safeguarding audits. Why is it important?

Let's personalize your content