Can Agentic AI in Fintech Transform Financial Services Through Autonomous Intelligence?

Fintech News

FEBRUARY 10, 2025

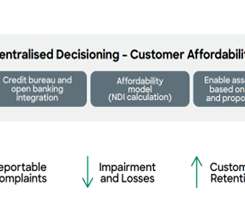

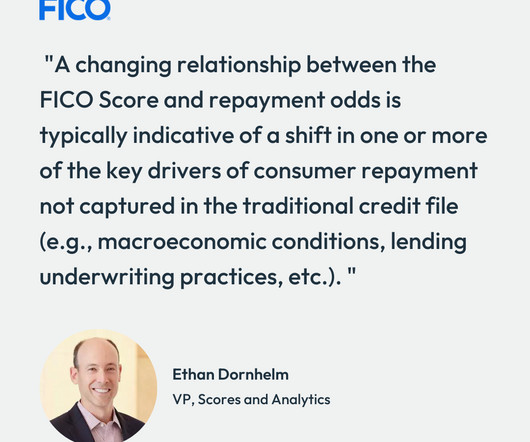

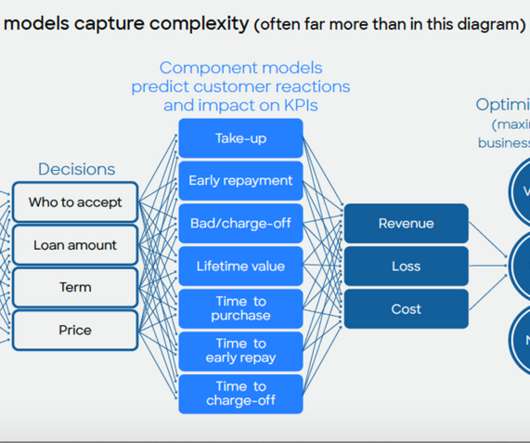

In fintech, Agentic AI could enhance fraud prevention, risk management, trading, and customer engagement by autonomously analysing financial data, detecting anomalies, and executing decisions in real time. But these systems still require users to set preferences, approve transactions, or manually adjust settings.

Let's personalize your content