Stripe Acquires Orum for Undisclosed Amount

Finovate

JULY 21, 2025

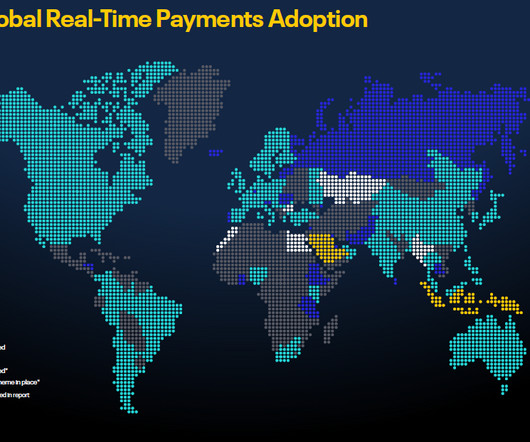

Stripe is acquiring payment orchestration startup Orum to enhance its real-time payments capabilities, including FedNow, RTP, and AI-driven instant payouts. The acquisition reflects Stripe’s broader strategy to lead in modern, fast, and seamless payment infrastructure amid growing global demand for real-time payments.

Let's personalize your content