Chips migrates to ISO 20022 message format

Finextra

APRIL 10, 2024

The Clearing House's Chips private-sector high-value clearing and settlement system has migrated to the ISO 20022 messaging format.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Finextra

APRIL 10, 2024

The Clearing House's Chips private-sector high-value clearing and settlement system has migrated to the ISO 20022 messaging format.

The Payments Association

JUNE 16, 2025

Offline settlements with a digital pound: Lessons from the BoE’s report 16 June 2025 by Payments Intelligence LinkedIn Email X WhatsApp What is this article about? These are linked to the requirement for instant offline settlement, i.e. digital money leaves the payer device to go into the payee’s device. Why is it important?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

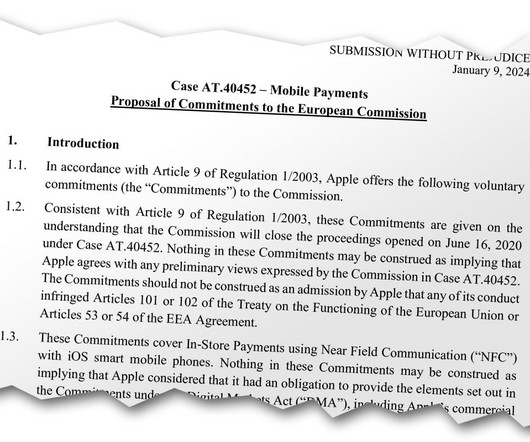

NFCW

JANUARY 23, 2024

To establish a dispute settlement mechanism under which Apple’s decisions denying access to NFC input will be reviewed by independent experts. EU calls for feedback on proposed settlement with Apple over NFC chip access was written by Sarah Clark and published by NFCW. Feedback should be submitted by 18 February 2024.

Finextra

DECEMBER 2, 2024

The CHIPS network, the largest private-sector high-value clearing and settlement system in the world which is operated by The Clearing House, set a new record for transaction volume on Black Friday by clearing and settling 1,083,550 payments valued at $2.63 trillion.

Stax

MARCH 4, 2025

TL;DR Online payments rely on API or hosted gateways with encryption and fraud detection, while in-store transactions require POS hardware with EMV chip technology and NFC capabilities. For enhanced security, it uses EMV (Europay, Mastercard, and Visa) chip technology and contactless payments, like Apple Pay and Google Pay.

Finextra

APRIL 17, 2024

one of the largest banks in Japan, and Crédit Agricole Corporate & Investment Bank, one of the leading investment banking groups in Europe, successfully completed the first payment in the ISO 20022 message format on The Clearing House’s CHIPS network, the largest private-sector high-value clearing and settlement system in the world.

Fintech Finance

APRIL 10, 2024

The CHIPS® network, the largest private-sector high-value clearing and settlement system in the world, which is operated by The Clearing House , successfully migrated to the ISO 20022 message format on the April 8 banking day. The CHIPS network settles an average of $1.8

Stax

NOVEMBER 14, 2024

This means you’ll be able to accept chip cards as well as contactless payment methods like contactless cards and digital wallets like Google Pay or Apple Pay. EMV Compliance Most businesses are aware by now that EMV is the chip card technology that has been rolling out across the USA over the past few years.

Finextra

FEBRUARY 18, 2025

The Chips network, the largest private sector high-value clearing and settlement system in the world, is leading the charge in optimizing liquidity efficiency and delivering significant economic benefits to participants.

Clearly Payments

MARCH 14, 2025

It occurs in a matter of seconds but consists of multiple stages, from authorization to settlement. Stage 2: Authentication and Security To prevent fraud, security measures are incorporated: EMV Chip Technology : EMV chips provide dynamic encryption for each transaction, making it harder to counterfeit cards.

Clearly Payments

MAY 22, 2025

Settlement A settlement is when the funds from a transaction are actually transferred to the merchant. Batch A group of transactions sent for settlement at the same time. Bank Accounts & Settlements Merchant Account A special account used to receive card payments. EMV Chip technology on credit cards.

EBizCharge

DECEMBER 18, 2024

A clearinghouse is an intermediary organization that facilitates the settlement of transactions, ensuring the accurate and efficient exchange of money, securities, or data between parties in financial or other transactional systems. This benefits buyers and sellers by providing quicker settlements. What is a clearinghouse?

PYMNTS

APRIL 18, 2019

The estimate is based on Qualcomm’s guidance that states it estimates an increase of $2 per share after the settlement. The settlement comes after a jury in federal court in San Diego last month sided with Qualcomm in its long-running patent court battle with Apple.

NFCW

JUNE 20, 2024

“Brussels regulators had argued the tech company was preventing competitors from accessing ‘tap-and-go’ chips or near-field communication (NFC) to benefit its own Apple Pay system. Brussels officials have been testing these measures, which Apple has offered to keep in place for a decade.

PYMNTS

MAY 16, 2020

The company said that the system “may record bank note serial numbers and denominations to prevent duplicate bank notes, [and] may ensure transaction security by storing transaction signing private keys on a chip or mobile device Secure Element (when available). Embodiments may also allow for user anonymity.”.

PYMNTS

JULY 23, 2019

Apple is reportedly in advanced talks to acquire chipmaker Intel Corp’s smartphone-modem chip business. Late last year, Apple acquired 300 engineers and facilities from Dialog Semiconductor PLC in a $600 million deal after the tech giant began started developing the battery-management chips Dialog had supplied.

Fintech Finance

NOVEMBER 20, 2024

Unified Payments Platform: Organisations can now manage all payments via one platform, featuring a streamlined settlement system that increases operational efficiencies. Multiple Payment Methods: Support for Chip & Pin, contactless, and mobile payments allows for increased flexibility and enhances the customer experience.

Fintech Finance

APRIL 17, 2024

one of the largest banks in Japan, and Crédit Agricole Corporate & Investment Bank , one of the leading investment banking groups in Europe, successfully completed the first payment in the ISO 20022 message format on The Clearing House’s CHIPS® network, the largest private-sector high-value clearing and settlement system in the world.

PYMNTS

APRIL 17, 2019

It’s a game Apple could be closer to joining now that it has reached a settlement with smartphone chip maker Qualcomm. Apple intends to take part in the 5G race, but the timing of Apple’s entry remains unknown, even after the Qualcomm settlement. And Huawei reportedly said it is willing to provide Apple with chips for 5G.

Finovate

DECEMBER 6, 2023

Earlier this month, the computing giant unveiled its latest computing chip, Condor , that has 1,121 superconducting qubits and can perform computations beyond the reach of traditional computers. IBM also released Heron , a chip with 133 qubits that boasts a lower error rate. IBM may be changing this, however.

PYMNTS

NOVEMBER 14, 2019

When chip cards began arriving in the U.S. In February , Visa and Mastercard, along with bank defendants, reached a settlement of about $6.24 Merchants can either eventually file a claim and ask for payment, object to the settlement or exclude themselves from the settlement class. billion from a class action suit. .

PYMNTS

OCTOBER 7, 2020

As noted by The Wall Street Journal and other sites, the statements came after a settlement between the EU and chipmaking giant Broadcom. Under the terms of that settlement, the EU has accepted Broadcom’s agreement not to craft any exclusivity pacts for chips that are used in television set-top boxes and modems through the next seven years.

Payments Dive

JULY 14, 2025

Editors picks Justin Sullivan via Getty Images Visa CEO ‘strongly’ disagrees with class settlement ruling The card network giant expects the parties to negotiate a new settlement following a judge’s rejection of an agreement reached earlier this year, but its CEO notes that could happen after a trial begins.

PYMNTS

APRIL 25, 2016

We believe the settlement we have been able to negotiate … provides significant benefits – both monetary and non-monetary – that will improve the work lives of the drivers and justifies this compromise result.”. We realize that some will be disappointed not to see this case go to trial,” Liss-Riordan said in a statement. “We

The Payments Association

NOVEMBER 18, 2024

As fintechs’ superior payment solutions lure away more merchants, banks stand to lose processing revenue and all-important settlement deposits. However, as the fintechs and PSPs continue to capture more of the merchant relationships, the banks’ supply of settlement deposits is diminishing.

PYMNTS

OCTOBER 21, 2020

As PYMNTS has noted in past studies, as recently as July, 76 percent of SMBs had been experiencing cash flow shortages – and a whopping 90 percent of Main Street SMBs want access to real-time settlement of funds. percent/30 cents per chip/swiped transaction, and higher for online payments. percent/10 cents and 2.9

ACI Worldwide Blog

MAY 13, 2024

In the domestic Real-Time Gross Settlement (RTGS)/Wire and cross-border payment spaces, transformation to the most recent ISO 20022 (HVPS+ and CBPR+) messaging standards has been ongoing since 2022. The North America Clearing House CHIPS wire system migrated in April 2024, and the U.S.

PYMNTS

DECEMBER 6, 2018

The Fed had discussed actions that could aid in the creation of a faster payment system, such as the development of a real-time settlement service. Retailers have already made changes to them to allow for the acceptance of chip-based cards.). As a result, it might not be easy to make them change to other payment methods.

Stax

MARCH 5, 2025

These devices read the data on the EMV chip of a customer’s physical card, or securely accept the data being transmitted by NFC for a contactless payment. Whether the payment is approved or rejected, if the funds are withdrawn and deposited into your business’s account–all of this is done by the payment processor.

Stax

APRIL 18, 2024

They often provide services such as authorization, clearing, and settlement. Step 3: Settlement With the authorization code in hand, the merchant proceeds with the transaction. At the end of the business day, the merchant batches all authorized transactions and submits them to the acquiring bank for settlement.

Fintech Finance

MARCH 31, 2025

The CHIPS ® network, the largest private-sector high-value clearing and settlement system in the world which is operated by The Clearing House, set a new daily record in late 2024 by clearing and settling 1,083,550 payments valued at $2.63 ” Electronic payments are increasing across all payment rails. trillion.

The Payments Association

OCTOBER 4, 2024

While technologies like EMV chip cards (chip & pin), tokenisation, and biometrics have been developed to enhance security, fraudsters continue to adapt. However, international transactions come with their own set of challenges, including fluctuating exchange rates, varying regulations, and complex settlement processes.

PYMNTS

JUNE 17, 2019

Apple is also reportedly making its own 5G chips, which could be ready as soon as 2022 or ‘23, and the company is moving forward on the tech despite the ban on Huawei by the United States. The phones will have 6.7-, 6.1- inch screens. inch will not be 5G compatible.

PYMNTS

OCTOBER 9, 2020

s move to consider more stringent regulation of tech mergers comes as a recent European Union settlement with chip-maker Broadcom has some technology industry watchers fearing that Europe, and potentially the U.K., may be entering an era of more robust regulation.

PYMNTS

APRIL 29, 2019

Existing payment networks such as ACH, The Clearing House Interbank Payments System (CHIPS) and SWIFT continue to see strong use, which is creating further reluctance among private parties to switch. Banks, then, need to offer these other payments methods and standards, or else risk losing their corporate clients to competitors.

PYMNTS

JANUARY 9, 2018

UnionPay’s global B2B payments solution first rolled out last year to support cross-border supplier payments, invoice management, foreign exchange settlement, accounts receivable and other B2B services. Exports made up 80 percent of that volume. market and allow tourists from China visiting the U.S.

PYMNTS

MAY 31, 2016

Apple and Caltech will be facing off in court over Wi-Fi chips, and whether or not Apple’s use of them constitutes a violation of a patent held by the university. The suit seeks to recover damages from the infringement and block the sale of the contested products until such a settlement is reached.

PYMNTS

OCTOBER 7, 2020

As noted by The Wall Street Journal and other sites, the statements came after a settlement between the EU and chipmaking giant Broadcom. Under the terms of that settlement, the EU has accepted Broadcom’s agreement not to craft any exclusivity pacts for chips that are used in television set-top boxes and modems through the next seven years.

Clearly Payments

FEBRUARY 12, 2024

These networks have transformed the way payments are processed, moving from paper-based transactions to electronic authorizations and settlements. These disruptors often focus on addressing pain points such as high transaction fees, lengthy settlement times, and lack of transparency associated with traditional card networks.

Payment Savvy

JULY 3, 2024

The transaction is completed if approved, and the funds are held for settlement. Clearing and Settlement At the end of a business day or a predetermined period, the merchant batches all approved transactions and submits them to the acquiring bank for settlement.

CB Insights

JANUARY 25, 2019

As cryptocurrencies seek mainstream adoption, look for movements by trusted blue-chip firms to stamp their approval on custodial tools. DLT in clearance and settlement. After years of experimentation, banks are still looking to reduce clearing and settlement inefficiencies with distributed ledgers. Decentralized exchanges.

Cardfellow

AUGUST 9, 2023

.” Card-present transactions include magstripe swipes, EMV chip card “dips,” and contactless payment “ta[s.” Settlement Time In addition to the other criteria noted, the transaction must be settled within 24 hours of the authorization.

Stax

FEBRUARY 28, 2024

TL;DR A payment terminal enables a merchant to take chip card and contactless payments. Only access the most recent batch and settlement data from that day. When you buy something at a store and insert your chip card into a machine that uses EMV technology, that’s a payment terminal. What is a Fully Integrated Terminal?

PYMNTS

DECEMBER 13, 2018

Separately, a number of retailers, among them giants Target and Walmart, have requested that the Federal Reserve create a real-time interbank settlement system. There also remains the fact that merchants and other businesses have already invested in hardware amid the transition to chip cards.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content