Cash App, Venmo app downloads decline

Payments Dive

FEBRUARY 5, 2025

Consumer downloads of apps like Cash App and Venmo dropped in the fourth quarter compared to the year-ago period, data from Wolfe Research shows.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

FEBRUARY 5, 2025

Consumer downloads of apps like Cash App and Venmo dropped in the fourth quarter compared to the year-ago period, data from Wolfe Research shows.

Fintech Finance

JANUARY 17, 2025

In a significant milestone for the fintech industry, Paysend , the UK-based global payments platform, has announced reaching 10 million consumer customers worldwide. The post Paysend Celebrates 10 Million Consumer Customers Milestone: Simplifying Cross-Border Payments for Everyone appeared first on FF News | Fintech Finance.

The Fintech Times

JANUARY 22, 2025

In 2024, consumer spending on in-app purchases and subscriptions hit $150billion globally, according to digital economy data provider, Sensor Tower. In its latest research, the firm uncovers how consumer spending on apps has evolved in the past year. Interestingly, consumers are not spending this money in the gaming sector.

PYMNTS

APRIL 9, 2020

consumers now report living paycheck-to-paycheck, and almost half have less than $2,500 in savings. How are consumers — especially those who live paycheck-to-paycheck — coping with the sudden and indefinite loss of reliable incomes? PYMNTS latest research shows that about six out of 10 U.S.

Advertisement

Think your customers will pay more for data visualizations in your application? Five years ago they may have. But today, dashboards and visualizations have become table stakes. Discover which features will differentiate your application and maximize the ROI of your embedded analytics. Brought to you by Logi Analytics.

Fintech Finance

MARCH 19, 2025

This report provides valuable insights into the usability factors that must be addressed to enhance the consumer and merchant experience and accelerate adoption. The full report, Overcoming Instant Payment QR Code Impediments to Adoption: Usability ,is now available for download from the FPC’s Faster Payments Knowledge Center.

The Fintech Times

JANUARY 30, 2025

As smartphone theft in the UK has more than doubled to 78,000 incidents in the past year alone, Nuke From Orbit is teaming up with ethical hacker Nikhil Rane to arm consumers with practical knowledge to protect their devices and personal data. By taking simple steps, consumers can significantly reduce their risk of falling victim.

PYMNTS

DECEMBER 14, 2020

Consumers’ daily lives look very different now than they did just one year ago. Consumers across the nation have instead hunkered down at home, working, socializing, shopping and paying online. Our research shows that just 20 percent of consumers own eReaders in 2020, for example, down from 23 percent in 2019 and 26 percent in 2018.

NFCW

JANUARY 16, 2024

.” Impact The authors of ‘Consumer Adoption and Use of Financial Technology: Tap and Go Payments’ found that “financial intermediaries play an important role in consumer adoption and use of payment technology. We document that these rules have a strong causal impact on the use of digital payment technology.

Fintech Finance

JANUARY 14, 2025

These case studies provide tangible examples of how CaaS has driven value, such as: Instant Issuance and Flexibility: CaaS enables businesses to issue and manage payment cards with speed (launching in days instead of weeks), removing the need for costly and time-consuming traditional models.

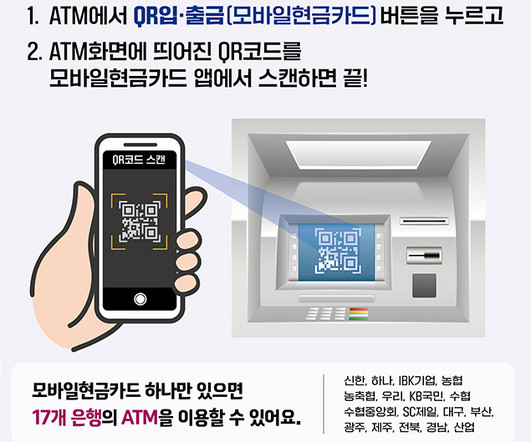

NFCW

DECEMBER 18, 2023

SCAN: Availability is being expanded from NFC on Android phones to QR Codes on all smartphones Consumers in Korea can now make cash withdrawals and deposits at ATMs by scanning a QR code with their Apple or Android smartphone rather than needing to use a physical bank card.

Fintech Finance

SEPTEMBER 9, 2024

An extract of Global A2A Payments Market: 2024-2029 , is now available as a free download. Vendors must capitalise on this opportunity and offer merchants A2A-specific solutions that enhance consumer payment experiences like VRPs, improving satisfaction and rewarding repeated payments.”

PYMNTS

AUGUST 5, 2020

The firm also said that WesternUnion.com was the most downloaded mobile app among peer money transfer companies during the quarter, according to mobile app marketing firm Sensor. That paid off during Q2 as the consumers and businesses all over the world pivoted to a digital-first mindset.

PYMNTS

MAY 7, 2020

It has been almost two months since the World Health Organization (WHO) first declared the coronavirus a pandemic on March 11, and it has since taken an unprecedented toll on consumers’ wellbeing and livelihoods. Among consumers who are still employed, 31.5 percent have reverted to working online remotely, for example, while 39.2

Fintech Finance

NOVEMBER 21, 2024

The report also uncovered the challenge many consumers face with using retail credit at Christmas, with 64% of people struggling to repay it, suggesting that many enter the New Year burdened by new debt. The arrival of Open Banking rules means that consumers can easily grant access to licenced providers to view their financial data.

Fintech Finance

JANUARY 2, 2025

.” The report highlights essential fraud mitigation strategies such as enhanced authentication, transaction monitoring, and confirmation of payee practices, as well as the importance of information sharing and consumer protection. stakeholders to adopt innovative approaches that protect consumers, businesses, and financial institutions.

Fintech Finance

FEBRUARY 20, 2025

The results reflect growing adoption of the FedNow Service and RTP Network and an expanding array of use cases in both consumer and business contexts. To learn more about the findings of the 2025 Faster Payments Barometer, download the comprehensive report: [link] The post U.S.

Fintech Finance

AUGUST 28, 2024

However, this increase in digital payments also brings about heightened risks – almost one in five consumers surveyed has fallen prey to online identity theft. More than one-third of consumers believe their data is less secure than it was five years ago, a figure that has increased steadily.

The Payments Association

DECEMBER 5, 2024

The paper argues that the current system of account-to-account (A2A) payments hinders consumer choice and investment and proposes a new model inspired by the success of the card payments model. Transforming the UKs Payments Infrastructure – a proposal – Click here to download the paper now

PYMNTS

NOVEMBER 24, 2020

Businesses and financial institutions (FIs) are constantly examining ways to make their customers’ accounts more secure, especially as more consumers go online to make purchases and transact during the ongoing COVID-19 pandemic. Developments From The Digital Consumer Onboarding Space. It also found that just 16 percent of U.S.

PYMNTS

SEPTEMBER 4, 2020

It has now been six months since the coronavirus outbreak was declared a pandemic on March 11, and consumers are more likely than ever to shop and pay online, not only for retail goods, but for groceries and food orders from restaurants. adults now purchasing food, groceries and retail items online. We surveyed 2,437 U.S.

PYMNTS

AUGUST 13, 2020

Amazon ’s reputation rests on providing consumers with almost anything they could want in one place — quickly — and with just a few clicks. It turns out that consumers may be more willing than expected go the extra mile to find their favorite products, though. The study is based on a survey of almost 2,200 U.S. We found that 58.4

PYMNTS

NOVEMBER 17, 2020

Consumers’ banking habits have changed radically since the pandemic was first declared in March. PYMNTS research shows that consumers are 8.7 PYMNTS research shows that consumers are 8.7 million consumers in the United States (or 42.4 percent more likely to use mobile banking apps now than they were in 2019, and 51.1

Open Banking

MAY 2, 2025

cVRPs are a pioneering new payment instruction, enabling consumers to limit the value of any payment from their account, offering a flexible alternative to Direct Debit and card-on-file payments. Consumers and businesses now make more than 27 million open banking-powered payments monthly, and this growth continues year-on-year.

PYMNTS

OCTOBER 1, 2020

Not surprisingly, consumers with lower incomes had less money to spend, and accordingly, the report showed that growth of personal spending also slowed for the fourth straight month, rising by just 1 percent in August. The company is also updating in-store signage to include the Walmart app icon and encourage shoppers to download it.

The Fintech Times

MARCH 25, 2025

By integrating blockchain-based payments into public finance using Keepz, taxpayers can now make payments via QR codes, without the need for app downloads or registrations, ensuring a frictionless user experience. “We believe financial freedom starts with choice, and we empower people to pay and get paid on their own terms.

PYMNTS

JANUARY 14, 2021

This means consumers are turning more to digital tools, but unlocking and embracing the potential benefits of these tools has not been easy. More than half of consumers find it difficult to locate relevant information on their banks’ websites, for example, a problem that led many to seek assistance in physical branches.

PYMNTS

SEPTEMBER 30, 2020

More than 100 million consumers in the United States have switched from shopping in stores to shopping online since the pandemic began, and 83 percent of them plan to keep shopping with merchants they have discovered since then, even after the crisis has subsided. The only question is: What do retailers have to do to win them over?

Fintech Finance

AUGUST 14, 2024

Over half of consumers worldwide (56%) have changed their spending habits from a year ago, not only becoming more price conscious but demanding payment choice, from debit cards and bank transfers to digital wallets and cash, according to new research from Paysafe (NYSE: PSFE), a global payment processor and digital wallet provider.

Fintech Finance

NOVEMBER 28, 2024

Alex Mifsud, CEO and co-founder of Weavr, commented on the report: “Benefits have become an essential tool for employee engagement in the UK and employee expectations have rapidly evolved to match their experience as consumers. To read more about the report, it can be downloaded from Weavr’s website here.

Fintech Finance

APRIL 4, 2025

“Credit and debit cards continue to play a leading role in the payment experience as money moves between banks, consumers, businesses and beyond in a complex, never-ending cycle. In the fight for customer loyalty, every payment card program is a vital opportunity to seize competitive advantage and drive growth. .”

Fintech Finance

JULY 23, 2024

UK consumers are leading the charge on digital financial services adoption amid rising demand for more innovation and convenience in payments and banking, according to a study from Marqeta (NASDAQ: MQ), the global modern card issuing platform powering some of today’s most innovative embedded finance solutions.

Fintech Finance

APRIL 10, 2025

Consumers will just need to download the app and simply scan a dedicated MPLUS Aleta QR code to pay merchants. “By integrating Aleta Planet’s advanced payment technology with MPLUS, we’re equipping consumers and merchants with the confidence to transact securely and efficiently.”

Fintech Finance

MARCH 27, 2025

Businesses can download the Cloud Commerce app from Google Play, log in with their NMI Gateway credentials, and immediately start accepting payments. By simply downloading the Mastercard Cloud Commerce app and connecting to the NMI Gateway, they can start processing payments quickly and securely. Currently available in the U.S.,

Fintech Finance

AUGUST 2, 2024

This partnership also provides access to a complimentary DashPass membership for existing Chase cardmembers and consumers who sign up now through December 31, 2027. We look forward to continuing our partnership with Chase to connect consumers to all their favorite local stores in a convenient, affordable way.”

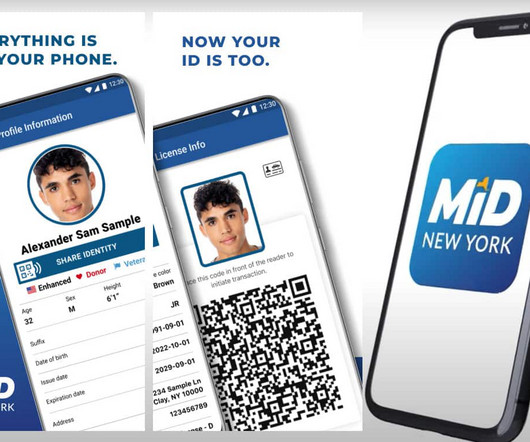

NFCW

MARCH 14, 2025

“Anyone with a valid New York State-issued driver license, learner permit, or non-driver ID can download the secure Mobile ID app on their Android or iOS device through Google Play or the App Store,” the Governor’s office says. New York reports on mobile ID adoption was written by Sarah Clark and published by NFCW.

Bank Automation

OCTOBER 22, 2024

US banks will now have to give customers access to their financial data after the top consumer watchdog finalized a long-awaited rule aimed at fueling more competition for financial products.

Payments Source

FEBRUARY 25, 2021

The COVID-19 pandemic led many locked-down consumers to stream or download more movies and video games, and this trend is leading to a rise in demand for faster data services such as 5G — a potential driver of payments innovation.

Fintech News

DECEMBER 19, 2024

While this is exciting for consumers, who enjoy greater convenience, it also translates into growing complexity for merchants, who must navigate an increasingly complex and fragmented landscape in which payment preferences vary widely from country to country from Alipay in China to UPI in India and e-wallets like DANA and GoPay in Indonesia.

Neopay

FEBRUARY 29, 2024

Recently, the Financial Conduct Authority (FCA) released its Consumer Duty firm survey findings for Autumn 2023, shedding light on the progress made by firms in implementing the Consumer Duty. At Neopay, we recognise the importance of regulatory compliance and consumer protection.

Fintech Finance

NOVEMBER 21, 2024

Featuring expert insight from companies like Absa and KFC, as well as extensive merchant and consumer survey data, the report highlights the convergence of commerce – an industry-defining trend that is set to deliver customer convenience and merchant efficiency.

Tearsheet

JULY 17, 2024

80% of consumers believe that easier access to this information would improve their process of investigating an unrecognized transaction, according to the research. In payments, consumers feel the most powerless when it comes to managing subscriptions. For banks, digital receipts are a customer retention strategy.

NFCW

JULY 1, 2024

The NFC Forum has detailed its vision for its planned introduction of Multi-Purpose Taps , which will enable multiple functions to be actioned via a single tap of an NFC device, in a new paper which is available to download from the standards body’s website.

Fintech Finance

JANUARY 20, 2025

The 2025 edition was based on a survey conducted on behalf of Paysafe by Sapio Research among 4,300 consumers who have been involved in, or have an interest in, sports betting across six U.S. About the 2025 All the Ways Players Pay Research Report Paysafe launched its All the Ways Players Pay research report series in 2019.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content