Driving Efficiency in Loans Against Mutual Funds with Tailored Loan Management System (LMS)

M2P Fintech

APRIL 10, 2025

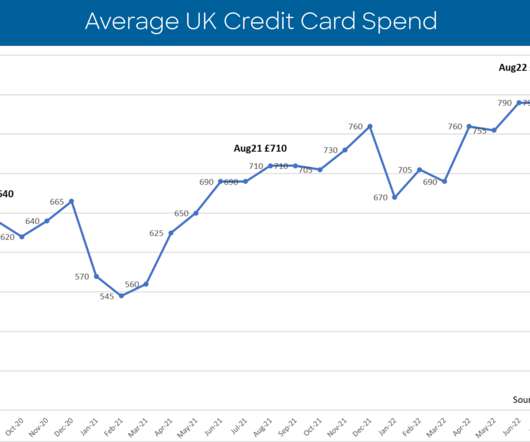

Supported by robust mutual fund collateral, LAMF enables financial institutions to extend lower interest rates to borrowers while significantly mitigating their own risk exposure. Provides real-time LTV ratio calculations and proactive shortfall alerts to maintain sufficient collateral coverage, mitigating risks from market volatility.

Let's personalize your content