Navigating legal uncertainty: How the Digital Assets Bill could impact PSPs

The Payments Association

JANUARY 13, 2025

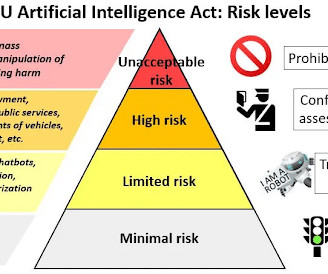

It is advised that firms ensure their custody arrangements, contracts and terms of service are aligned with these legal definitions in the interest of avoiding disputes while strengthening consumer trust. This could lead to disputes over ownership, custody, and liability in cases where the legal framework is yet to be fully tested.

Let's personalize your content