How to Optimize Your Invoicing and Billing Processes

EBizCharge

MAY 22, 2025

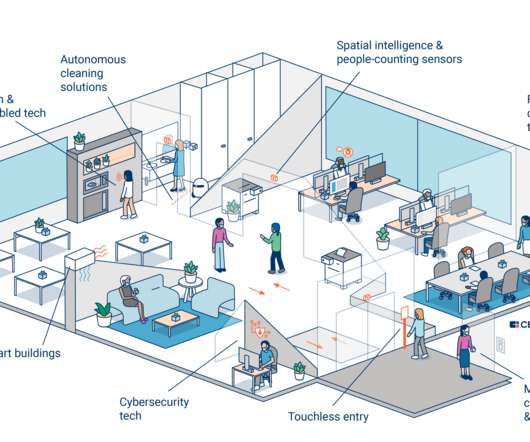

6 common challenges in invoicing and billing Understanding various invoicing and billing challenges will allow your business to proactively mitigate these issues to maintain positive financial health and reputation. Standard templates also facilitate easier integration with accounting software, further streamlining the billing process.

Let's personalize your content