Zebra launches Android NFC smartphone with built-in RFID tag reading

NFCW

JANUARY 23, 2025

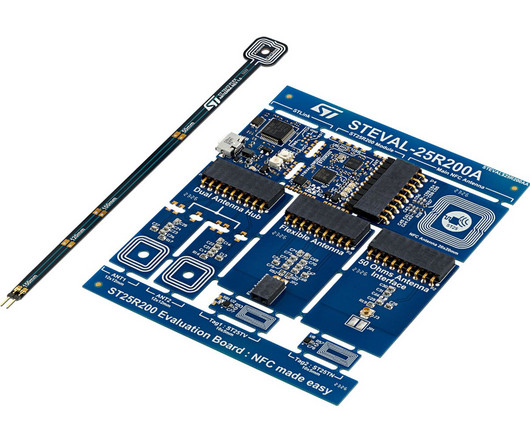

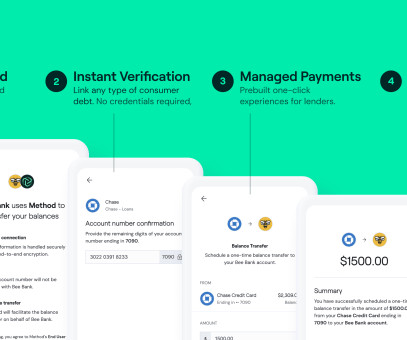

ANDROID: Zebra’s EM45 RFID smartphone can read both UHF RFID and NFC tags Zebra Technologies has unveiled an enterprise Android smartphone that comes with built-in support for both ultra high frequency (UHF) RFID and NFC tag reading and the ability to also function as a contactless payments acceptance device. The launch follows news from Qualcomm that the mobile chipset giant is actively working to add support for ultra high frequency Rain RFID tag reading to mobile devices, initially for

Let's personalize your content