Mastercard acquires cybersecurity firm for $2.65B

Payments Dive

SEPTEMBER 12, 2024

The acquisition is the latest in a series of cybersecurity firm purchases by the card network over the years.

Payments Dive

SEPTEMBER 12, 2024

The acquisition is the latest in a series of cybersecurity firm purchases by the card network over the years.

Open Banking Excellence

SEPTEMBER 12, 2024

11-12th November 2024 Live Event Linkedin Twitter FTT Fintech Festival Join c-level executives, founders and technology leaders from across financial institutions, fintechs and technology providers as we explore the digital transformation of the financial services landscape. From their analysis of the macroeconomic context to the drivers of changing customer behaviour, their views will help set the scene for an ever-evolving industry.

Payments Dive

SEPTEMBER 12, 2024

Real-time payments and open banking will drive the increase, forcing the shift even faster globally, a Capgemini report released this week said.

Finextra

SEPTEMBER 12, 2024

Mastercard has struck a deal to buy threat intelligence specialist Recorded Future from private equity form Insight Partners for $2.

Speaker: Jason Cottrell and Gireesh Sahukar

Retailers know the clock is ticking–legacy SAP Commerce support ends in 2026. Legacy platforms are becoming a liability burdened by complexity, rigidity, and mounting operational costs. But modernization isn’t just about swapping out systems, it’s about preparing for a future shaped by real-time interactions, AI powered buying assistants, and flexible commerce architecture.

NFCW

SEPTEMBER 12, 2024

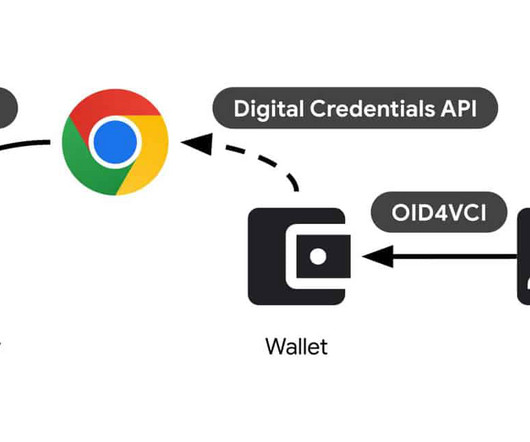

VERIFICATION: The Digital Credentials API will use digital IDs to verify website users A new Digital Credentials API that will allow visitors to a website to verify their identity using a driver’s license or a national identification card stored in their digital wallet has now entered testing. “The API will also soon be used by Google Accounts to verify certain users’ date of birth,” Google developer advocate Eiji Kitamura explains in a blog post. “Users residing wi

Fintech Finance

SEPTEMBER 12, 2024

J.P. Morgan Payments has announced new and enhanced product integrations connecting to the Oracle ecosystem, making it easier for clients to streamline their payments across treasury, trade and commerce. Since 2021, J.P. Morgan Payments and Oracle have been partnering to provide mutual corporate clients enhanced functionality and easier connectivity.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Fintech Finance

SEPTEMBER 12, 2024

Flutterwave , Africa’s leading payment technology company, today announced that its flagship remittance product, Send App by Flutterwave, has launched commercially in Malawi. Customers can continue to use Send App to facilitate faster, easier, and more affordable cross-border money transfers into Malawi. Send App offers all customer segments in the country the opportunity to receive money on both mobile apps and web devices.

Finextra

SEPTEMBER 12, 2024

Flutterwave, Africa’s leading payment technology company, today announced that its flagship remittance product, Send App by Flutterwave, has launched commercially in Malawi. Customers can continue to use Send App to facilitate faster, easier, and more affordable cross-border money transfers into Malawi.

Fintech Finance

SEPTEMBER 12, 2024

MoonPay is pleased to announce that MoonPay is registered with the Australian Transaction Reports and Analysis Centre (AUSTRAC) to provide digital currency exchange services in Australia. This will help MoonPay establish local payment processing relationships across the country and consequently enable Australian payment methods. As a result, MoonPay may enable its users in Australia to use alternative payment methods such as Osko and PayID.

Fi911

SEPTEMBER 12, 2024

An issuer decline code is provided by an issuing bank to a merchant, indicating the rejection of a credit card transaction. This means that the issuer has halted or blocked the transaction. The specific code gives a brief reason for why the issuer turned down the purchase. There are many reasons for an issuer to decline a transaction. Common reasons include suspected fraud and insufficient funds in the cardholder’s account.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Fintech Finance

SEPTEMBER 12, 2024

Companies using Mastercard Business cards in the Eastern Europe, Middle East and Africa (EEMEA) region are set to benefit from a new value-added service – a business subscription management tool powered by technology partner Nuclei. The innovative feature will help small businesses streamline processes and reduce costs. In the first wave, Mastercard and Nuclei are planning to launch the user- and budget-friendly platform in the GCC region, followed by the rest of EEMEA.

The Payments Association

SEPTEMBER 12, 2024

Open banking enhances financial convenience and transparency, but security depends on using regulated providers and careful data sharing.

Fintech Finance

SEPTEMBER 12, 2024

Kuady , the leading payments service processor, for Latin America, has today announced the launch of the Kuady Card, an innovative virtual prepaid Mastercard now available to users in Peru. The new card is designed to provide a secure, flexible, and convenient way for users in the region to make payments. Online merchants will be able to pay out directly to Kuady accounts, enabling them to build stronger relationships with their customers by providing a faster, more efficient payment method.

Stax

SEPTEMBER 12, 2024

Cash is no longer having its moment; card payments are in. From debit and credit cards to Google or Apple Pay, digital, contactless, and mobile payments are on the rise. That’s why for most businesses, it’s almost impossible to make do without a credit card terminal. Finding the right credit card machine that fits your business model, however, isn’t always an easy task.

Speaker: Benjamin Woll, Tiffany Spizzo, and Jaime Santos Alcón

Enterprise commerce is at an inflection point. Rigid, monolithic platforms slow brands down, but a full replatforming is disruptive and costly. Modular architecture offers a flexible, scalable alternative - allowing enterprise brands to modernize without ripping and replacing their entire stack. Learn how a composable approach helps modernize commerce stacks while maintaining control over critical systems.

Fintech Finance

SEPTEMBER 12, 2024

Global fintech Unlimit today announced a strategic partnership with the global AI-commerce technology company, Shoplazza. The partnership is focused on enhancing cross-border payment services for e-commerce merchants in APAC. Shoplazza merchants will be able to leverage Unlimit’s extensive portfolio of payment methods and robust payment infrastructure to expand their customer bases worldwide, bolster customer satisfaction, and improve customer retention.

Finextra

SEPTEMBER 12, 2024

The Interledger Foundation, an organization building and advocating for an open, interoperable payment network, and Chimoney, a fintech company providing multi-currency wallets and infrastructure for cross-border payments, today announced their work to power cross-border payments between more than 130 countries worldwide.

Fintech Finance

SEPTEMBER 12, 2024

The Interledger Foundation , an organization building and advocating for an open, interoperable payment network, and Chimoney , a fintech company providing multi-currency wallets and infrastructure for cross-border payments, today announced their work to power cross-border payments between more than 130 countries worldwide. Together, they will enable consumers without bank accounts to send and receive money through bankless digital wallets, as well as instantly convert it into a traditional or e

Bank Automation

SEPTEMBER 12, 2024

Bank of America is investing in technology initiatives as automation and digitalization remain priorities. The $3.2 trillion bank spends $12 billion annually on technology, a Bank of America spokesperson told Bank Automation News. Nearly a third of that $12 billion is spent on technology initiatives including innovation, Chief Executive Brian Moynihan said Sept. 10 at […] The post Bank of America spending $12B on technology annually appeared first on Bank Automation News.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Fintech Finance

SEPTEMBER 12, 2024

Network International (Network) , the leading enabler of digital commerce across Africa and the Middle East, has announced that Zambian fintech and neobank, Lupiya , has appointed Network as their digital payments technology partner to launch a new debit card. The solution includes the launch of a debit card that is e-commerce enabled, together with 3D Secure and tokenization.

Bank Automation

SEPTEMBER 12, 2024

AI coupled with an open banking framework provides better access to credit for consumers. The technology presents an opportunity for consumers with limited credit to obtain loans and make payments, Ben Soccorsy, head of data access and business development at Mastercard, said this week during the Finovate Fall event in New York City. By combining […] The post AI, open banking to boost consumer credit access appeared first on Bank Automation News.

Fintech Finance

SEPTEMBER 12, 2024

Nium , the global leader in real-time cross-border payments, has announced two executive appointments that strengthen its leadership team and underscore the company’s focus on driving efficient and responsible growth. Andre Mancl joins as Chief Financial Officer. He will oversee all financial strategies for the company and will lead Nium’s global finance organization, including planning, treasury, tax, reporting, corporate development, and investor relations.

Finextra

SEPTEMBER 12, 2024

Social investing platform eToro's US business has agreed to pay $1.5 million and stop trading activity in nearly all crypto assets to settle Securities and Exchange Commission charges.

Speaker: Becky Parisotto and John Vurdelja

Fulfillment is no longer just about getting products from point A to point B – it's about crafting seamless, scalable, customer first experiences. Flexible fulfillment strategies are more important than ever for those aiming to stay ahead and build resilience as retail enters a new era in 2025. Learn how to optimize fulfillment processes, tackle complex, multi-vendor orders, and create seamless customer experiences – from white-glove delivery for high-value items to quick-ship solutions for ever

Fintech Finance

SEPTEMBER 12, 2024

Ebury , a global fintech company specialising in payments and collections, FX risk management and business lending, partners with Salt Edge , a leading open banking solution provider, to integrate its PSD2 APIs. This collaboration will enable both companies to enhance visibility and attract new customers while offering existing customers open banking services.

Payments Dive

SEPTEMBER 12, 2024

The payments software provider is making “immediate bets” on the Brazil and Mexico markets, a company executive said.

The Fintech Times

SEPTEMBER 12, 2024

The fifth iteration of the ‘Fintech for Inclusion Global Summit’ took place at the Tobacco Dock in Wapping, London, bringing together the industry’s frontrunners who are making an impactful change to the fintech market. The event saw over 270 attendees and put a twist on a standard fintech event. Rather than hosting a variety of panels, Accion Venture Lab , the Mastercard Center for Inclusive Growth , and the Dutch entrepreneurial development bank FMO put together an event whi

The Paypers

SEPTEMBER 12, 2024

Global fintech company Ebury has announced its partnership with Salt Edge in order to expand its Open Baking presence in the regions of the EU and the UK.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Finextra

SEPTEMBER 12, 2024

Asset servicer Northern Trust has launched a blockchain-based platform which enables institutional buyers to digitally access carbon credits.

The Paypers

SEPTEMBER 12, 2024

Walmart Marketplace has partnered with US-based fintech startup Parafin to provide sellers with capital through the Walmart Marketplace Capital programme.

The Fintech Times

SEPTEMBER 12, 2024

Consumers are increasingly turning to digital payment methods instead of cash across the UAE and Saudi Arabia, according to new data from Checkout.com , the global payments solution provider. New Checkout.com research now reveals a 26 per cent year-on-year rise in the number of unique cards used for online purchases in the UAE and Saudi Arabia between July and August, suggesting that people are increasingly going online for purchases.

The Paypers

SEPTEMBER 12, 2024

ConnectID has grown its network by joining forces with Lendela , a digital loan matching platform, to boost the security and efficiency of loan applications for consumers in Australia.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Let's personalize your content