Google Pay taps Affirm, Zip for BNPL

Payments Dive

DECEMBER 13, 2023

The tech giant has linked with the buy now, pay later companies to develop installment payment options to be offered next year.

Payments Dive

DECEMBER 13, 2023

The tech giant has linked with the buy now, pay later companies to develop installment payment options to be offered next year.

Payments Next

DECEMBER 11, 2023

By Steve Kramer, VP Product, PayNearMe Though many of us manage our bill payments quite smoothly, you might be surprised to learn The post Three best practices to boost on-time payments using personalized links first appeared on Payments NEXT.

Stax

DECEMBER 20, 2023

When you research payment solution providers , you’ll start hearing the term “interchange” used when talking about payments. Interchange is the fee that credit card companies like Visa and Mastercard charge businesses to accept their cards. The interchange fee depends on a number of factors and isn’t always easy to understand. In this article, we will break down credit card interchange fees so you will know exactly how much you’re spending when running your business.

Fintech Weekly

DECEMBER 6, 2023

AI regulation might prevent the European Union from competing with the US and China.

Speaker: Jason Cottrell and Gireesh Sahukar

Retailers know the clock is ticking–legacy SAP Commerce support ends in 2026. Legacy platforms are becoming a liability burdened by complexity, rigidity, and mounting operational costs. But modernization isn’t just about swapping out systems, it’s about preparing for a future shaped by real-time interactions, AI powered buying assistants, and flexible commerce architecture.

Fintech News

DECEMBER 17, 2023

Traditional banking systems, burdened by age and complexity, can cripple innovation, restrain time to value, and strain customer relationships. This is not an isolated challenge; many incumbent banks struggle to keep ownership and maintenance costs in check and swiftly expand product offerings to compete with nimble challenger banks. Digital transformation is no longer a choice; it’s a lifeline.

Faster Payments Council

DECEMBER 1, 2023

The Spring Member Meeting will bring together FPC members for two days filled with presentations on the most pressing issues in faster payments, panel discussions with industry experts, roundtables on timely topics, and engaging networking opportunities. This in-person event will take place on March 27-28, 2024, at the Walt Disney World Swan & Dolphin Resort in Lake Buena Vista, FL.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Payments Next

DECEMBER 6, 2023

By Michael Engel, Managing Director & VP Software | Banking, Diebold Nixdorf The race to seamlessly integrate financial services into everyday consumer The post Navigating the embedded finance revolution: Strategies for simplifying legacy bank technology first appeared on Payments NEXT.

The Fintech Times

DECEMBER 18, 2023

It’s a time of reflection and anticipation at The Fintech Times throughout December, as we look back at developments and trends over the last 12 months and forward to the year ahead. We’re pleased to share the thoughts of fintech CEOs and industry leaders from across the globe to 2023’s key takeaways and what we should expect to be top of the agenda in 2024.

Fintech Weekly

DECEMBER 6, 2023

At the recent Payment Card Industry Security Standards Council (PCI SSC) Community Meetings in North America and Europe, the premiere conference for everything related to the payment card and financial payment industry, several topics were top of mind for participants and attendees. For instance, many discussions around emerging payment technologies ease assessment across various PCI standards, as well as conversations about the challenges businesses and assessors face in implementing ongoing ch

Fintech News

DECEMBER 6, 2023

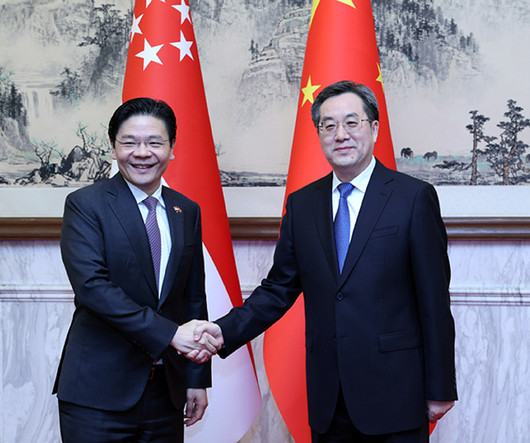

Singapore and China have agreed to collaborate on a pilot programme that uses the e-CNY, China’s central bank digital currency (CBDC), for cross-border transactions. This programme is designed to ease payments for travelers from both countries during their overseas visits. This pilot programme is part of a series of initiatives announced following the 19th Joint Council for Bilateral Cooperation (JCBC) in Tianjin.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Finextra

DECEMBER 13, 2023

Fintech is a fast-changing ecosystem where there are few certainties. As 2023 comes to an end, it’s.

Payments Dive

DECEMBER 11, 2023

The network is advancing technologies to let consumers and businesses more easily use its cards, after doubling the number of merchants that accept them over the past five years.

TechCrunch Fintech

DECEMBER 10, 2023

Welcome back to The Interchange, where we take a look at the hottest fintech news of the previous week. If you want to receive The Interchange directly in your inbox every Sunday, head here to sign up! We’re looking at a bunch of news — from new unicorns, to a fintech doing good, to one that shut […] © 2023 TechCrunch. All rights reserved.

The Finance Weekly

DECEMBER 20, 2023

If you're in charge of a team, you understand the importance of using ,, workforce planning software in today's business world. Without the right tools tailored to your company's needs, it's challenging to keep up and stay competitive. This article will highlight essential features to seek in workforce management tools and then introduce some top choices to enhance your workflow.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Finovate

DECEMBER 4, 2023

I’ve received dozens of 2024 fintech trends prediction pitches in my email inbox over the past month. And while many of them are insightful, I wanted to see what our AI overlord ChatGPT had to say about the matter. My prompt read, “What are your predictions for the top five newest and hottest trends in fintech for 2024?” Here is how the AI responded: Predicting the exact trends for 2024 is speculative, but here are potential emerging trends in fintech: Embedded Finance : Furthe

Fintech News

DECEMBER 13, 2023

Singaporean payment institution FOMO Pay and United Arab Emirates’ digital bank Zand have partnered to improve cross-border payment efficiency between Asia and the Middle East and North Africa (MENA) region. This collaboration seeks to streamline B2B transactions and enhance the speed and cost-effectiveness of international remittances. The partnership between FOMO Pay and Zand Bank is expected to benefit businesses by offering more competitive rates and improved efficiency in handling pay

Finextra

DECEMBER 13, 2023

Japanese card issuer JCB is moving to Phase 2 of a pilot to trial offline P2P payments for a central bank digital currency (CBDC).

Payments Dive

DECEMBER 8, 2023

Sen. Dick Durbin took to the Senate floor Thursday to push for a vote on the Credit Card Competition Act, taking a swipe at United Airlines along the way.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

TechCrunch Fintech

DECEMBER 15, 2023

Welcome to Startups Weekly. Sign up here to get it in your inbox every Friday. You shouldn’t compare apples to oranges, but similarly, comparing iPhones to Androids is a fool’s errand as well. Now that Apple is finally phasing out the Lightning connector after 11 years in favor of the more universal standard USB-C (across […] © 2023 TechCrunch.

The Finance Weekly

DECEMBER 20, 2023

If you're in charge of a team, you understand the importance of using ,, workforce planning software in today's business world. Without the right tools tailored to your company's needs, it's challenging to keep up and stay competitive. This article will highlight essential features to seek in workforce management tools and then introduce some top choices to enhance your workflow.

Wharton Fintech

DECEMBER 6, 2023

11:FS CEO David M. Brear — the banking battlefield, fintech for SMEs & financial ecosystems globally In today’s episode, Kailee Costello hosts David Brear, the CEO and co-founder of 11:FS and one of the hosts of the Fintech Insider podcast. In today’s episode, David shares his insights on 3 topics: How digital technologies and fintechs have unleashed innovation in commercial banking.

The Fintech Times

DECEMBER 12, 2023

It’s a time of reflection and anticipation at The Fintech Times throughout December, as we look back at developments and trends over the last 12 months and forward to the year ahead. We’re excited to share the thoughts of fintech CEOs and industry leaders from across the globe to 2023’s key takeaways and what we should expect to be top of the agenda in 2024. insights served up today cover a wide range of topics, including investment trends in Latin America, the resilience of in

Speaker: David Nisbet, Everett Zufelt, and Michaela Weber

Once upon a time, in the vast realm of online commerce, there lived a humble checkout button overlooked by many. Yet, within its humble click lay the power to transform a mere visitor into a loyal customer. 🧐 💡 Getting checkout right can mark the difference between a successful sale and an abandoned cart, yet many businesses fail to make payments a part of their commerce strategy even when it has a direct impact on revenue.

Finextra

DECEMBER 10, 2023

Canada has finalised a deal with Visa and Mastercard to lower credit card interchange fees for small businesses.

Payments Dive

DECEMBER 20, 2023

This primer fills in the gaps on how digital wallets work, what companies compete to provide such payment tools and what to expect from them in the future.

TechCrunch Fintech

DECEMBER 17, 2023

Welcome back to The Interchange, where we take a look at the hottest fintech news of the previous week. If you want to receive The Interchange directly in your inbox every Sunday, head here to sign up! What a year This is the last edition of The Interchange for 2023 — it’s hard to believe that the […] © 2023 TechCrunch. All rights reserved. For personal use only.

The Finance Weekly

DECEMBER 13, 2023

FP&A Software Cube is reportedly in “turmoil” after suffering a spate of high profile exits and ongoing turnover, according to ex-employees at the company. Former Cube employees, speaking on the condition of anonymity, revealed that the New York-based FP&A solution recently let go of their Head of Sales and Head of Product The company is increasingly run by the company’s CEO Christina Ross and her head of Human Resources, the sources claim.

Speaker: Benjamin Woll, Tiffany Spizzo, and Jaime Santos Alcón

Enterprise commerce is at an inflection point. Rigid, monolithic platforms slow brands down, but a full replatforming is disruptive and costly. Modular architecture offers a flexible, scalable alternative - allowing enterprise brands to modernize without ripping and replacing their entire stack. Learn how a composable approach helps modernize commerce stacks while maintaining control over critical systems.

Fintech News

DECEMBER 19, 2023

The global fintech landscape is witnessing a staggering growth, fueled by booming consumer adoption, supportive regulatory efforts and technological advancements. Between 2015 and 2019, consumer adoption of digital money transfer and payment services grew from a mere 18% to an impressive 75%, findings from a Statista survey found. Insurtech, alternative lending and online savings and investment recorded similar spectacular growths, surging between 20 to 40 points during the period.

BlueSnap

DECEMBER 21, 2023

For many businesses, 2023 has been about making the most of the time, resources and money at hand. Our most read content within our Resource Center says a lot about what businesses are thinking about payments today and their impact on the bottom line. The post The Best of BlueSnap: The Top 10 Payment Content Pieces of 2023 appeared first on BlueSnap.

Finextra

DECEMBER 18, 2023

Apple, Visa and Mastercard are facing a class action lawsuit over allegations that they conspired to suppress competition in the market for point-of-sale payment card services.

Payments Dive

DECEMBER 14, 2023

Such scams are expected to jump 50-plus percent to $3 billion by 2027, forcing financial institutions to address the rising threat, according to a new report.

Speaker: Becky Parisotto and John Vurdelja

Fulfillment is no longer just about getting products from point A to point B – it's about crafting seamless, scalable, customer first experiences. Flexible fulfillment strategies are more important than ever for those aiming to stay ahead and build resilience as retail enters a new era in 2025. Learn how to optimize fulfillment processes, tackle complex, multi-vendor orders, and create seamless customer experiences – from white-glove delivery for high-value items to quick-ship solutions for ever

Let's personalize your content