Credit Card Merchant Services: What to Look for (and What Most Businesses Miss)

Stax

MAY 13, 2025

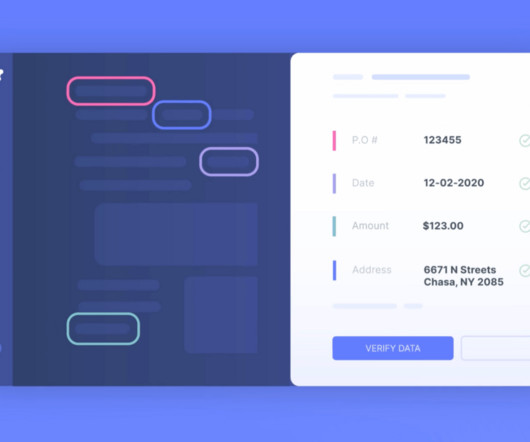

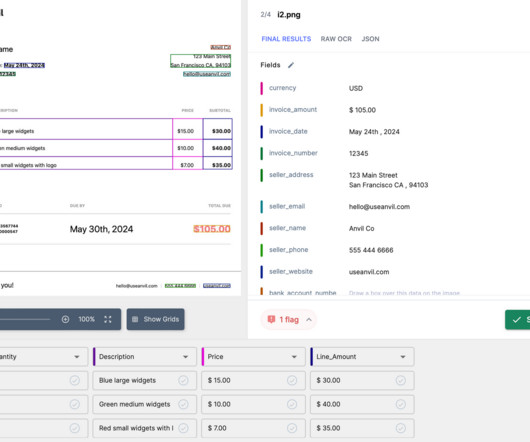

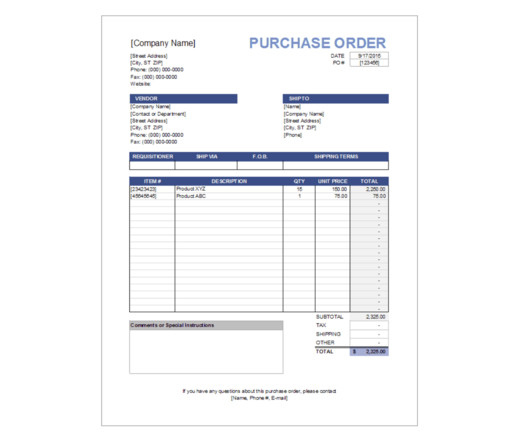

Credit card merchant services are the systems, tools, and agreements that allow businesses to accept payments via credit and debit cards. That leads to fragmented data, inconsistent customer experiences, and duplicated efforts. Talk to sales What Are Credit Card Merchant Services?

Let's personalize your content