How PCI DSS Compliance Protects Australian Businesses from Data Breaches?

VISTA InfoSec

MARCH 13, 2025

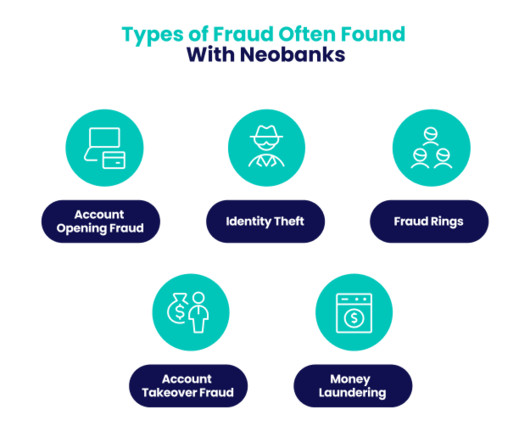

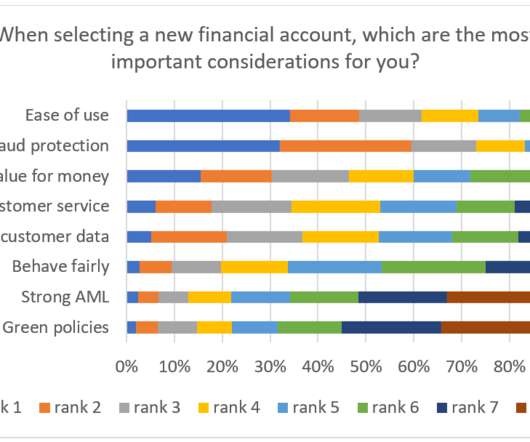

A brief introduction to PCI DSS PCI DSS is a global data security framework that protects businesses handling cardholder data (CHD) from data breaches, fraud, and identity theft. To Conclude The rising threat of data breaches in Australia underscores the critical importance of robust cybersecurity practices.

Let's personalize your content