CFPB's Chopra reminds payments players they're in his sights

Payments Dive

JULY 14, 2022

In a blog post this week, the director reiterated that payments processors, credit card issuers and debt collectors are attracting scrutiny from his agency.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

JULY 14, 2022

In a blog post this week, the director reiterated that payments processors, credit card issuers and debt collectors are attracting scrutiny from his agency.

Cardfellow

MARCH 9, 2025

What are virtual credit cards? Virtual credit cards, as their name implies, are digital versions of credit cards. There is no physical card. Theyre linked to the customers account through their card issuer and used (primarily) for online purchases. How do customers pay with a virtual credit card?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

FICO

OCTOBER 6, 2016

One of the key contributors to this blog, Dr. Scott Zoldi, has just been named one of the winners of the first Analytics 50 Awards by Drexel University’s LeBow College of Business and CIO.com. The awards program honors 50 executives who are using analytics at their organizations to solve business challenges.

PYMNTS

FEBRUARY 15, 2018

13) that it disabled the ability for customers to add new credit cards as a payment method for those in the U.S. We know many customers have added credit cards as their primary payment method; we did not make this decision lightly. customers should switch their payment method to debit card or a bank account.

Cardfellow

JUNE 14, 2025

With a staged wallet, the card issuer or card network doesn’t necessarily know what type of card was used or other useful information. The post Staged Digital Wallet Fees appeared first on CardFellow Credit Card Processing Blog. The wallet essentially acts as a middleman.

PYMNTS

JULY 21, 2017

In a blog post yesterday, PayPal said the deal with JPMorgan Chase will drive increased choice, flexibility and value for their joint customers, as well as enable the company to make further inroads into physical stores. card issuers, Magats said. “We said Dan Schulman, president and CEO at PayPal, in the post.

PYMNTS

JANUARY 4, 2019

One might say that card issuers were throwing rewards at customers like they were going out of style — particularly in light of the fact that these days it seems they have in fact gone out of style. In fact, in some cases, being so generously rewarding is actually costing card issuers money, instead of making it for them.

PYMNTS

OCTOBER 14, 2019

Latin America Google Pay exec Joao Felix said that there are 60 million people with debit cards in Brazil and only 50 million with credit cards. Increasing and enabling debit card payments will help Google to grow, he said. . So will Mastercard, Visa, Elo, iFood and Rappi. . In June, Google Pay announced support for PayPal.

FICO

NOVEMBER 28, 2017

In a previous blog I have written about the messaging that is, or rather isn’t happening to consumers around PSD2. We are now seeing some attempts to educate the public, though this is often hidden in the issuing of new terms and conditions for bank accounts, or in media scare stories that suggest a customer data free-for-all.

PYMNTS

OCTOBER 14, 2019

Latin America Google Pay exec Joao Felix said that there are 60 million people with debit cards in Brazil and only 50 million with credit cards. Increasing and enabling debit card payments will help Google to grow, he said. . So will Mastercard, Visa, Elo, iFood and Rappi. . In June, Google Pay announced support for PayPal.

PYMNTS

APRIL 17, 2018

While consumers are definitely out of the loop when it comes to their rewards credit cards, they aren’t the only ones to blame,” NextAdvisor wrote in the blog post. Since credit card issuers are in control of their cards’ rewards and redemption opportunities, it’s clear that some issuers are also failing to educate their cardholders.”.

FICO

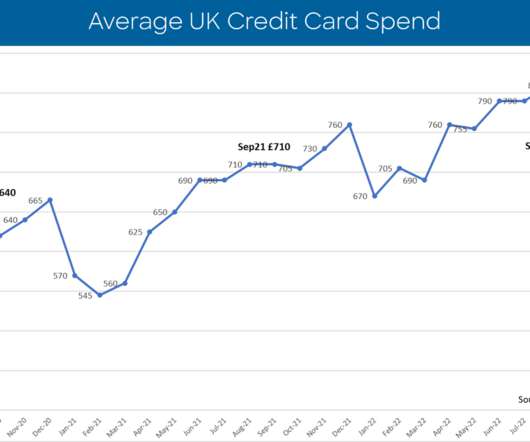

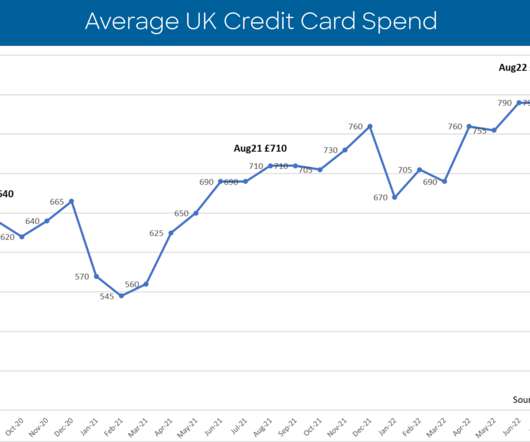

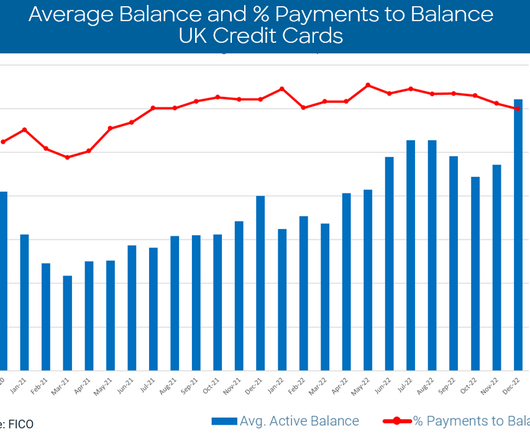

JUNE 28, 2022

UK Credit Card Trends: Cost-of-Living Stress Starts to Show in Data. FICO’s report of April 2022 UK card trends shows some early signs of the impact of the widely reported cost-of-living pressures. chevron_left Blog Home. UK Cards Report: Credit Card Payments Yet To Show Signs Of Distress. Darcy Sullivan.

FICO

MAY 9, 2023

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80% of UK card issuers.

FICO

APRIL 8, 2016

We first blogged about sharp growth in ATM fraud last May, and the trend we saw then has only gotten worse. It has also taken on some new patterns: shorter compromises with fewer cards. Here are some tips: If an ATM looks odd, or your card doesn’t enter the machine smoothly, consider going somewhere else for your cash.

FICO

NOVEMBER 29, 2022

UK Cards Data: September Data Shows Rising Consumer Stress. With the rise in inflation and soaring energy costs in the UK, it’s no surprise that our data on UK card trends for September 2022 offer clear signs of consumer indebtedness. How FICO Can Help You Manage Credit Card Risk and Performance. chevron_left Blog Home.

FICO

OCTOBER 19, 2022

UK Card Risk Trends: Summer Data Indicates Challenges Rising. FICO’s report of UK card risk trends for summer 2022 (June-August) paints a picture of inconsistent consumer behaviour and market patterns which will be challenging for lenders to manage as the cost-of-living crisis impacts financial spending and consumer finances.

FICO

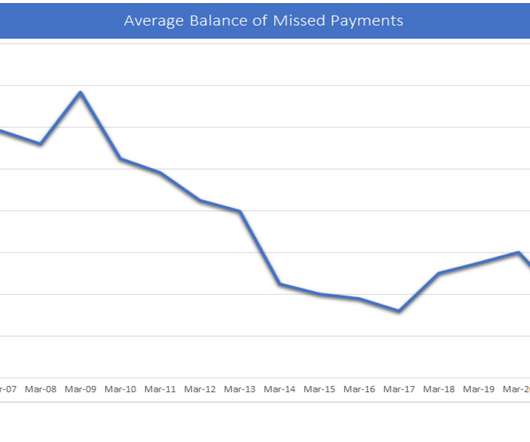

FEBRUARY 28, 2019

Balance roll rates — overdue balances on UK cards that go from one 30-day cycle to the next without repayment — moved slightly higher in 2018. Our analysis of data from 11 card issuers across the UK shows the areas that warrant attention from card issuers. From Current to 1 Cycles. At their peak in 2006, 5.2%

FICO

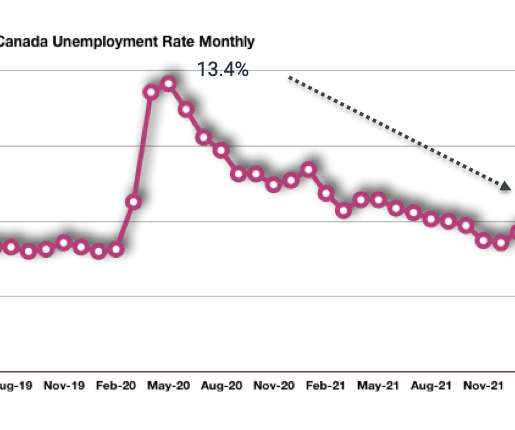

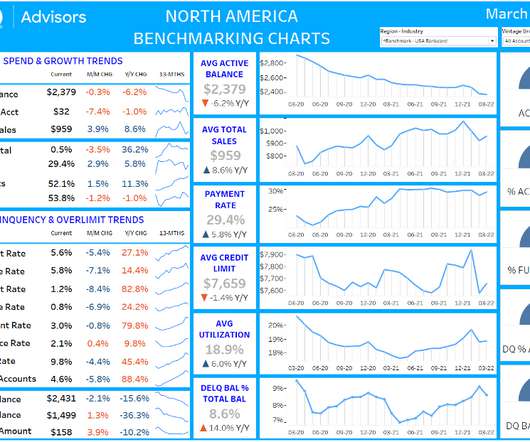

JUNE 7, 2022

Previously, these were published on the FICO Community, but going forward they will be published on the FICO.com blog. Previously, these were published on the FICO Community, but going forward they will be published on the FICO.com blog. FICO® Advisors regularly monitor in-depth data reported by Canada’s leading credit card issuers.

FICO

MARCH 23, 2023

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80 percent of UK card issuers.

FICO

FEBRUARY 22, 2023

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client finance reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80% of UK card issuers.

FICO

JANUARY 24, 2023

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80 percent of UK card issuers.

FICO

MARCH 15, 2019

Clearly, the UK regulator felt organisations were not doing enough and prescribed what should be done on card customers who qualified as persistent debtors. FICO Blog[/caption]. How can it still be ignored by card issuers dealing with persistent debt and IFRS 9? Persistent Debt. The decision tree below seems appropriate.

FICO

JANUARY 22, 2021

Last year I blogged a lot about how payments and fraud patterns have changed. But despite the COVID pandemic having effected massive changes in the ways consumers transact, credit card fraud is still a “thing,” and a big, ever-changing thing at that. Special Tools to Combat Credit Card Fraud.

Stax

APRIL 10, 2025

Contact us 10 Top Payment Methods for Small Businesses Credit and debit card payments Card payments (credit cards and debit cards) account for 50% of the total number of small business transactions and remain the primary way customers make purchases on-site and online.

FICO

DECEMBER 23, 2019

One of the most popular FICO blogs is Sarah Rutherford’s “What is Authorised Push Payment Fraud?” Liz Lasher recently blogged about FICO’s new authentication and identity proofing solutions , which provide much stronger methods of proving who you are, including voice, behavioral biometrics and more. The Scams You Don’t Hear About.

FICO

JUNE 16, 2022

FICO releases quarterly US Bankcard Industry Benchmarking trends, previously these were published on the FICO Community but going forward will be published on FICO.com blog. The following credit card performance figures represent a national sample of approximately 130 million accounts that comprise FICO® Advisors’ Risk Benchmarking solution.

FICO

MARCH 9, 2022

Our survey showed a positive outlook for banks and card issuers investing and innovating significantly in the digital space. When you consider that 66 million credit cards were issued in the UK from January 2012 to February 2020, this is a problem and a significant risk. Read our blog on our new Retail Banking 3.0

Stax

JANUARY 10, 2024

The exact rate can vary based on several factors, including the type of card used (debit or credit), the card brand (Visa, MasterCard, etc.), In addition to generating revenue for the card network, the purpose of credit card transaction fees is to cover operational costs and risk management.

FICO

MAY 31, 2022

Elo, one of the largest and most innovative payment providers in Brazil, has used FICO® Falcon® Fraud Manager to reduce fraud by 30 percent for card issuers using its payment network. Read this blog on why proactive customer communication is so important for fraud prevention . Reducing fraud during an e-commerce boom.

FICO

JUNE 1, 2023

Looking ahead, 2023 could have some bumps in the road for consumers and those who are trying to manage risk in a credit card portfolio. If you are a consumer that is falling behind, you can reach out to your credit card issuer for help.

FICO

AUGUST 16, 2022

To relieve some of this pressure, more credit card issuers are turning to digital communications. If you have questions or are interested in discussing these insights in more detail please contact me, Leanne Marshall, through comments on this blog or at leannemarshall@fico.com. chevron_left Blog Home. Saxon Shirley.

FICO

JUNE 27, 2023

Key Trend Indicators – UK Cards March 2023 Key Trend Indicators – UK Cards April 2023 These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. How to Turn UK’s Consumer Duty Compliance to Your Advantage

FICO

APRIL 19, 2023

Home Blog FICO UK Credit Cards: Are "Established" Accounts in Trouble? These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service.

FICO

SEPTEMBER 5, 2022

European Card Fraud in 2021: Winners, Losers and Scams. The United Kingdom and the Nordic region continue to lead Europe in terms of digital transformation and fraud loss reduction - but non-card scams are rising fast. As such, the UK’s challenges and successes can be instructive for card issuers in other countries across Europe.

FICO

MAY 7, 2019

Instead, the policy requires card issuers to take a number of escalating steps, informing the customer after 18 and 27 months of persistent debt, and eventually going through a forbearance process before month 36, which might include actions like card closure and interest waivers. Decision Options.

Exact Payments

AUGUST 23, 2023

In this blog, we’ll look at these and other ways embedded payments can provide positive benefits and sustainable growth for your B2B recurring billing and subscription management SaaS. Customers will also appreciate features like a wide variety of B2B payment options, lower fees, payment automation/reconciliation, and fast onboarding.

FICO

SEPTEMBER 13, 2022

UK Credit Card Trends: From 2008 Crash to Cost-of-Living Crisis. Changes in card management, customer behaviour and regulations make card delinquencies and other trends very different from the crash of 2008. How FICO Can Help You Manage Credit Card Risk and Performance. chevron_left Blog Home. Darcy Sullivan.

PYMNTS

JUNE 8, 2016

They will also share stories on how these and other challenges have dramatically held some card issuers back. As a trusted advisor, Alexander is often asked to share her perspectives at key industry conferences as well as through security-focused blogs and articles. Hannah Preston.

FICO

MARCH 25, 2021

FICO’s chief analytics officer, Dr. Scott Zoldi, unpacks unsupervised models, which he refers to as “little crystal balls” in this great blog post. . Performance benchmarking: FICO provides cloud-based model performance benchmarking dashboards that banks and card issuers can use to assess their fraud management strategies.

FICO

JULY 2, 2018

When consumers get a call, text, email or in-app messages from their card issuer asking them to validate a transaction, or informing them of fraud on their card, they may not even suspect that behind this bit of excellent customer service are a brilliant set of algorithms, such as neural networks.

FICO

OCTOBER 30, 2019

Although I still have accounts with the credit union in my story, I also have financial relationships with multiple banks, credit card issuers, and investment organizations. In my next blog, I will discuss how to identify the data sources you will need. Wrangle the data so it can be effectively used for analysis.

Payment Savvy

JUNE 12, 2023

If you find yourself facing the all too frequent Venmo “there was an issue with your payment” predicament, we hope to alleviate some of the anxiety through this blog post today. There are several reasons why a ‘Venmo payment declined’ issue might exist.

PYMNTS

MAY 7, 2018

percent of each credit card transaction plus 30 cents, which is shared among Amazon, card issuers and payment networks. Amazon is also offering discounts to merchants who use its online payments service. According to Bloomberg, online merchants using Amazon’s service have paid about 2.9 Google Pay Takes The Web.

FICO

JULY 3, 2018

When consumers get a call, text, email or in-app messagea from their card issuer asking them to validate a transaction, or informing them of fraud on their card, they may not even suspect that behind this bit of excellent customer service are a brilliant set of algorithms.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content