CFPB Slaps Equifax With $15Million Fine for Mishandling Consumer Credit Disputes

The Fintech Times

JANUARY 21, 2025

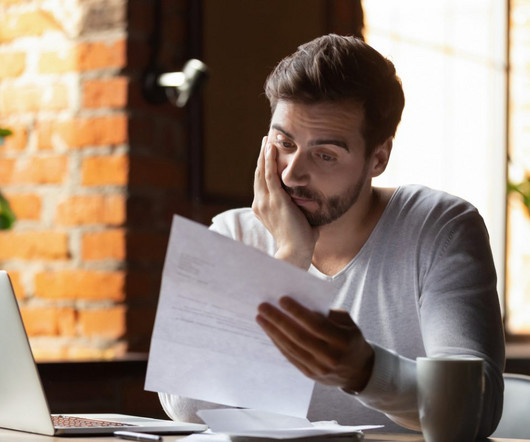

The Consumer Financial Protection Bureau (CFPB), the consumer protection agency in the US, has hit Equifax with a $15million fine, after it found that the nationwide consumer reporting agency failed to conduct proper investigations of consumer disputes. ” Once paid, CFPB will deposit Equifax’s fine into its victim relief fund.

Let's personalize your content