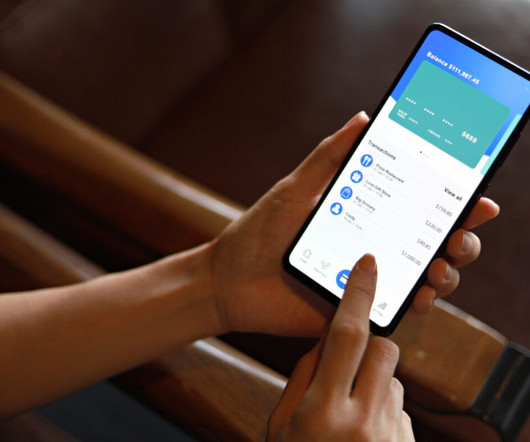

Zimpler Introduces ID+: A Next-Gen Identification Layer for Digital Payments

Fintech Finance

JULY 8, 2025

With Zimpler ID+, we’re introducing a flexible approach that gives businesses more control over identity flows – without compromising security or relying solely on external systems” said Gunnesson. It removes the need for deposit triggers, repeated logins, or re-verification after a device change.

Let's personalize your content