Payment Processing USA: 2024 Market Overview

Clearly Payments

NOVEMBER 6, 2024

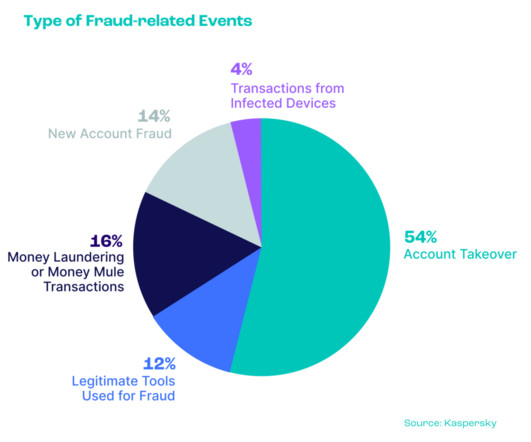

They can also offer additional services like fraud detection, chargeback management , and analytics. market’s total transaction volume in 2023 was over $10 trillion, encompassing credit and debit card transactions as well as Automated Clearing House (ACH) payments. Credit cards accounted for around $5.6

Let's personalize your content