Merchant Underwriting: What It Is, How It Works, and Why It’s Important

Stax

JANUARY 23, 2025

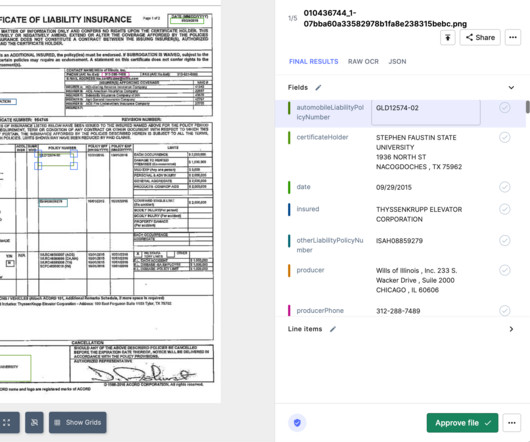

Key steps include application review, risk assessment, credit checks, and compliance verification. Merchant account underwriting is the evaluation process payment processors use to assess whether a business meets the criteria for accepting credit card payments. Reducing potential losses from high-risk merchants.

Let's personalize your content