Shift4 shrinks workforce

Payments Dive

AUGUST 3, 2023

The payments company cut 150 employees in the second quarter, executives said Thursday during an earnings conference call.

Payments Dive

AUGUST 3, 2023

The payments company cut 150 employees in the second quarter, executives said Thursday during an earnings conference call.

VISTA InfoSec

JULY 31, 2023

The PCI DSS Checklist is a crucial first step in securing your business. It’s a tool that helps businesses ensure they’re meeting all the requirements of the Payment Card Industry Data Security Standard (PCI DSS). By following the steps outlined in the checklist, businesses can take a comprehensive approach to security measures and access controls, and respond to new threats posed by technological advancements.

The Finance Weekly

JULY 31, 2023

Artificial Intelligence (AI) is gradually revolutionizing various industries, including the field of accounting and finance. With the emergence of , AI tools and Large Language Models (LLMs) like ChatGPT, Google Bard, and BERT, professionals in these fields can benefit from enhanced capabilities and streamlined processes. In a recent webinar sponsored by Datarails , the FP&A solution for Excel users, three distinguished finance leaders came together to discuss the impact of AI on corporate f

Payment Savvy

AUGUST 3, 2023

What Are BINs? A Bank Identification Number (BIN) is the first four or six numbers found on any debit or credit card. Essentially, this set of digits specifies the financial institution that issued a payment card. Every BIN number can be checked to prevent fraud and ensure the protection of both merchants and consumers when shopping. When you run any BIN number through a checking system, you end up with accurate information about the geolocation, card issuer, and card type.

Speaker: Jason Cottrell and Gireesh Sahukar

Retailers know the clock is ticking–legacy SAP Commerce support ends in 2026. Legacy platforms are becoming a liability burdened by complexity, rigidity, and mounting operational costs. But modernization isn’t just about swapping out systems, it’s about preparing for a future shaped by real-time interactions, AI powered buying assistants, and flexible commerce architecture.

Payments Dive

AUGUST 2, 2023

The payments processor launched a service during the second quarter aimed at affording ISVs the benefits of being a payment facilitator without the drawbacks associated with such a designation.

Nanonets

JULY 31, 2023

In this blog post, we explore Language Learning Models (LLMs) and their astounding ability to chat with PDF files. To start, we will show you how to chat with PDF files via the ChatGPT website. Next, we dive into a detailed code tutorial on how to chat with all kinds of PDF files. After that, we build our first automation to automate a repetitive task involving PDFs using ChatGPT API.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

The Paypers

AUGUST 4, 2023

Tempo France , an EU-based payment system operator, has planned to supply the local Philippine market with a complete business solution for remittances from the EU to the Philippines.

Payments Dive

AUGUST 2, 2023

The retailer, which is pulling support on Nov. 1, had sought to tap into gaming culture to make crypto a larger part of the company’s future.

National Processing

JULY 31, 2023

Mobile payments include digital wallets, apps, and other technology that allow customers to pay without pulling out cash or a card. Here’s everything merchants need to know about this latest payment trend. The post Adapting to the Shift to Mobile Payments: 6 Things Every Business Needs to Know appeared first on National Processing.

Agile Payments

AUGUST 3, 2023

How to Address "Friendly Fraud" and Chargeback Abuse Photo by Cup of Couple from Pexels

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

The Paypers

AUGUST 2, 2023

Cryptocurrency worth more than USD 1.5 billion has been removed from Curve Finance after a hack, impacting the DeFi market in the process.

Payments Dive

JULY 31, 2023

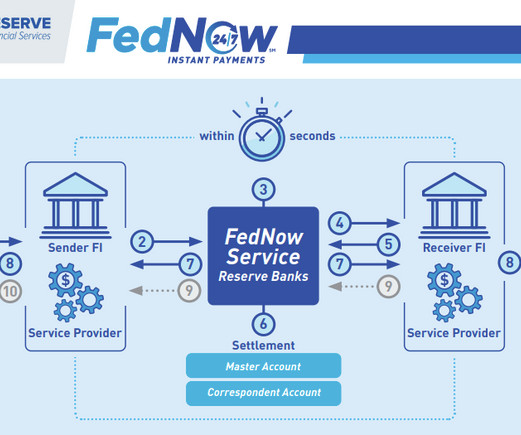

As the only two real-time payments rails in the U.S., the rivalry between RTP and FedNow could get intense, but maybe not.

Finextra

AUGUST 4, 2023

Watch this webinar on the importance of network analytics with financial crime and compliance organisations, and best practices for deploying this technology.

Nomentia

AUGUST 3, 2023

Intercompany payment processes often become complicated when organizations have operations in multiple countries. It means that payments need to be made globally, in various currencies, and often from various bank accounts since no bank can cover accounts for all business units or subsidiaries globally. The result: tens, hundreds, or thousands of bank accounts to be managed, more intercompany transactions than necessary, increased transaction costs, higher FX rates, and FX exposure, to mention o

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

The Paypers

JULY 31, 2023

US-based payments and money transfer company MoneyGram has partnered with Venezuela-based bank Banesco to expand its digital receive network.

Payments Dive

AUGUST 1, 2023

E-commerce company Shopify is adopting more artificial intelligence by automating its corporate expenses through Ramp.

ACI Worldwide Blog

AUGUST 2, 2023

En busca de las ventajas económicas de unos pagos más rápidos y eficaces, la mayoría de los mercados más importantes ya cuentan con sistemas de pagos inmediatos o los están desarrollando, por lo que la atención se está centrando en impulsar su adopción. The post Historias de éxito de los principales sistemas de pagos inmediatos del mundo appeared first on ACI Worldwide.

Nanonets

AUGUST 2, 2023

Electronic Export Information (EEI) came into existence in the United States to collect export data. No matter how big or small your business is, if you're exporting goods overseas with shipments valued at over $2,500 , you'll need to file an EEI. Since its introduction, EEI has significantly impacted businesses that export goods. It helps to track the movement of goods, ensures border security, and allows the US Department of Commerce to regulate the flow of goods in and out of the co

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

The Paypers

JULY 31, 2023

HAYVN Pay , a regulated cryptocurrency payment solution, has announced a partnership with CrossBet , a regulated online betting operator in Australia.

Payments Dive

JULY 31, 2023

The Federal Reserve’s new instant payments system is driving more merchant interest in pay-by-bank capabilities for consumers, a Fiserv executive said.

ACI Worldwide Blog

AUGUST 2, 2023

En busca de las ventajas económicas de unos pagos más rápidos y eficaces, la mayoría de los mercados más importantes ya cuentan con sistemas de pagos inmediatos o los están desarrollando, por lo que la atención se está centrando en impulsar su adopción. The post Historias de éxito de los principales sistemas de pagos inmediatos del mundo appeared first on ACI Worldwide.

Currencycloud

AUGUST 1, 2023

The third quarter of 2022 was the slowest for VC funding since the start of the pandemic, causing many Fintechs to put their ambitions on hold, in what has been described as a 'Fintech Winter'. Yet consumer behaviour and expectations of what Fintechs should offer them hasn’t stopped. If anything, it’s accelerated. It’s the Fintechs who’ve tuned into this who are succeeding in an otherwise challenging global market, proving that there are still opportunities out there.

Speaker: Benjamin Woll, Tiffany Spizzo, and Jaime Santos Alcón

Enterprise commerce is at an inflection point. Rigid, monolithic platforms slow brands down, but a full replatforming is disruptive and costly. Modular architecture offers a flexible, scalable alternative - allowing enterprise brands to modernize without ripping and replacing their entire stack. Learn how a composable approach helps modernize commerce stacks while maintaining control over critical systems.

The Paypers

JULY 31, 2023

International banking group Standard Chartered has announced its partnership with Ant Group in order to promote sustainable developments around the globe.

Payments Dive

AUGUST 4, 2023

This is the payments company’s fourth move to expand its international business this summer.

Fi911

AUGUST 1, 2023

An innovative payment service has just made its debut in the finance sector. The US Federal Reserve has introduced FedNow ; a new instant payment platform that will facilitate transactions at any given time. This is distinct from other customer-centric payment services like Venmo or Zelle in that its implementation hinges on the adoption by banking institutions.

Nomentia

AUGUST 1, 2023

Just a short while ago, PWC released its 2023 Global Treasury Survey Insights. Not much later, the EACT published the EACT Treasury Survey 2023. Both reports have emphasized the importance of cash flow forecasting and how high cash and liquidity management has been on the treasury community’s agenda.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

The Paypers

JULY 31, 2023

Spain-based bank BBVA has partnered with Banco Santander and CaixaBank in a joint effort to fight financial fraud.

Payments Dive

AUGUST 4, 2023

The company is pulling the plug on Cash App’s Verse brand in the European Union and buy now, pay later operations in Spain, France and Italy.

BlueSnap

AUGUST 1, 2023

The holiday shopping season will be here before you know it, so you need to be sure your online store is ready to receive (and accept payments from) all of your holiday shoppers. Here are 5 holiday eCommerce tips to help you make the most of this festive shopping season. 1. The post 5 Tips to Get Ready for the eCommerce Holiday Rush appeared first on BlueSnap.

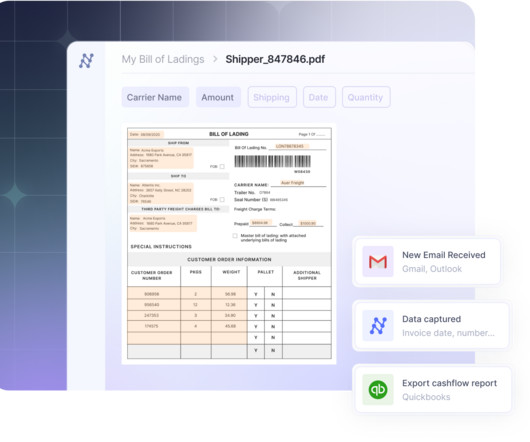

Nanonets

AUGUST 1, 2023

Invoice imaging isn't a futuristic technology straight out of Star Wars anymore. Most of us have scanned a QR code or used Google Lens OCR capabilities to translate street signs in real time. The recent advancements in AI and ML have made invoice imaging software much more robust, enabling AP teams to automate some of the most tedious aspects of the accounts payable processes.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Let's personalize your content