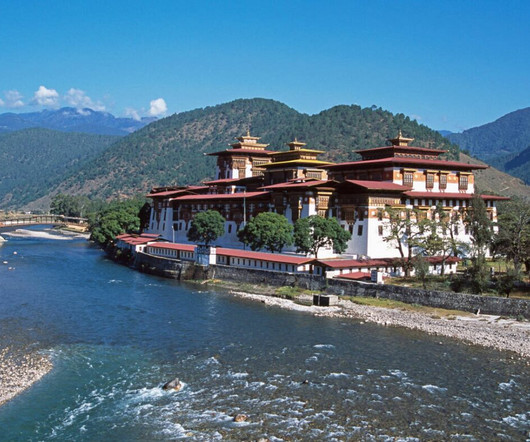

Tradition and Technology: Bhutan’s Journey into Fintech and Financial Inclusion

The Fintech Times

NOVEMBER 2, 2024

Banks By 2020, Bhutan’s financial sector included five banks, three insurance companies, one CSI bank, five microfinance institutions, one pension institution, two telecom companies as well as a single stock exchange. These advancements offer the potential to boost economic development and prosperity across the Kingdom.

Let's personalize your content