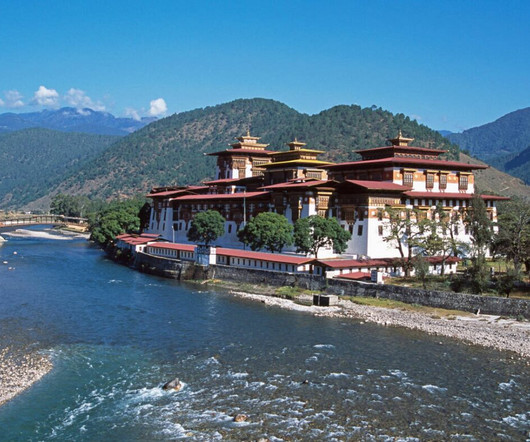

Tradition and Technology: Bhutan’s Journey into Fintech and Financial Inclusion

The Fintech Times

NOVEMBER 2, 2024

A handicrafts shop manager in Thimphu described the challenges posed by the lack of ATMs, credit card authorisation systems, and other financial infrastructure catering to international customers. According to the 2022 Bhutan Living Standards Survey Report, 95 per cent of households own a smartphone, 99.6

Let's personalize your content