P2P payments tools lack transparency, consumer group says

Payments Dive

OCTOBER 2, 2024

Zelle, the popular peer-to-peer payment service, and rivals should be more upfront with consumers about the ability to ask for money back, Consumer Reports says.

Payments Dive

OCTOBER 2, 2024

Zelle, the popular peer-to-peer payment service, and rivals should be more upfront with consumers about the ability to ask for money back, Consumer Reports says.

Finextra

OCTOBER 2, 2024

The Financial Conduct Authority has fined Starling Bank £29 million for failings related to its financial sanctions screening.

Fintech News

OCTOBER 2, 2024

Google has revealed plans to invest US$1 billion in Thailand, constructing a data center and cloud region in Bangkok and Chonburi. This move is projected to boost Thailand’s GDP by US$4 billion by 2029 and create an average of 14,000 jobs annually from 2025 to 2029. The investment aims to address the increasing demand for cloud services in Southeast Asia.

Finextra

OCTOBER 2, 2024

A recently released survey has highlighted a widespread lack of awareness among UK adults when it comes to open banking.

Speaker: Jason Cottrell and Gireesh Sahukar

Retailers know the clock is ticking–legacy SAP Commerce support ends in 2026. Legacy platforms are becoming a liability burdened by complexity, rigidity, and mounting operational costs. But modernization isn’t just about swapping out systems, it’s about preparing for a future shaped by real-time interactions, AI powered buying assistants, and flexible commerce architecture.

Fintech News

OCTOBER 2, 2024

South African digital bank, TymeBank , has surpassed the milestone of 10 million users just under six years after its launch in 2019. The bank, which is the first digital bank in Africa to reach profitability, now holds close to R7 billion (US$402.5 million) in customer deposits, making it one of the fastest-growing bank in South Africa based on deposits for 2024.

Bank Automation

OCTOBER 2, 2024

Tens of thousands of Bank of America clients reported outages of online and mobile banking services today. At 1 p.m. ET, more than 20,000 clients had reported issues with the $3.2 trillion bank, according to website Downdetector, which publishes the status of outages in real time. Many clients posted to social platform X to alert […] The post Bank of America mobile app, digital interface down appeared first on Bank Automation News.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

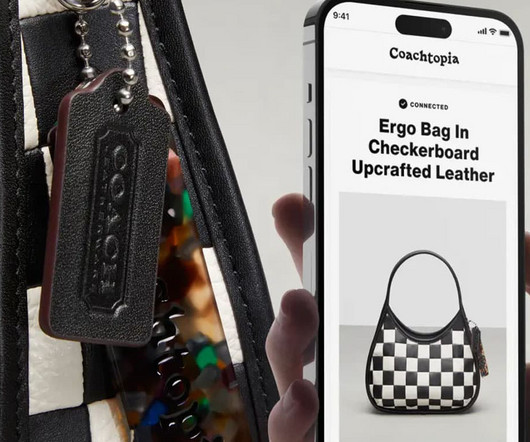

NFCW

OCTOBER 2, 2024

SEAMLESS RESALE: The NFC tag enables owners to prove provenance and resell the item via Poshmark : Owners of handbags, wallets, clothes and shoes from Coach’s sustainable Coachtopia brand can now resell these items on the Poshmark secondhand platform and have the details uploaded automatically, thanks to an NFC tag or digital ID embedded in each product.

Fintech Finance

OCTOBER 2, 2024

BKN301 Group , a London-based leading digital payments and Banking-as-a-Service (BaaS) provider in the MENA region, unveiled its latest innovative payment solution, ‘301 Retail Account.’ The solution is a payment account that will support the MENA region’s rapidly evolving financial landscape and will cater to the unique needs of traditional banks, fintech companies, and neobanks.

Finextra

OCTOBER 2, 2024

Klarna, the AI-powered global payments network and shopping assistant, has unveiled “Apple from Klarna”, a storefront in the Klarna app and Klarna.com where customers can purchase Apple products using its flexible payment options.

Fintech Finance

OCTOBER 2, 2024

Kazang , the prepaid value-added services (VAS) and card acquiring business within JSE-listed fintech Lesaka Technologies, has launched its Kazang Pay card acceptance solution for merchants in Zambia. Kazang Pay makes it affordable for merchants to accept card payments on the same Kazang terminal they use to sell prepaid products and services. The Kazang Pay enabled terminal in Zambia accepts VISA debit and credit cards as well as mobile wallet payments.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Payments Dive

OCTOBER 2, 2024

The card network will acquire the Swedish business in a bid to provide consumers with a centralized hub for managing their subscriptions.

Fintech Finance

OCTOBER 2, 2024

Klarna , the AI-powered global payments network and shopping assistant, has unveiled “Apple from Klarna”, a storefront in the Klarna app and Klarna.com where customers can purchase Apple products using its flexible payment options. Now an official Apple reseller, Klarna also launches a brand new, bespoke payment option for Apple products: Upgrade Financing.

Finextra

OCTOBER 2, 2024

There has been a "significant shift" in UK banks' attitude to AI with greater adoption and greater recognition of its benefits, according to recently published research.

Fintech Finance

OCTOBER 2, 2024

As part of its ongoing investment in its B2B network and in enhancing buyer and supplier capabilities, American Express has announced a new offering by Boost Payment Solutions , a global leader in payments, to provide commercial virtual Card processing services to U.S. merchants who accept American. Qualified American Express merchants will now have access to Boost Intercept®, Boost’s patented Straight-Through Processing (STP) solution, at no additional cost.

Speaker: Benjamin Woll, Tiffany Spizzo, and Jaime Santos Alcón

Enterprise commerce is at an inflection point. Rigid, monolithic platforms slow brands down, but a full replatforming is disruptive and costly. Modular architecture offers a flexible, scalable alternative - allowing enterprise brands to modernize without ripping and replacing their entire stack. Learn how a composable approach helps modernize commerce stacks while maintaining control over critical systems.

The Fintech Times

OCTOBER 2, 2024

Ripple Global Payments & Financial Solutions for Businesses , the provider of digital asset infrastructure, has expanded its global footprint as a regulated entity as it secures in-principle approval from the Dubai Financial Services Authority (DFSA) to expand its services from the Dubai International Financial Centre (DIFC). The in-principle licence approval from the DFSA underscores Ripple ’s strategy to expand its presence in the Middle East, following the establishment of its regional he

Fintech Finance

OCTOBER 2, 2024

Woodforest Acceptance Solutions, a leader in payment processing solutions, today announced a strategic partnership with FreedomPay , a leading global commerce platform. This collaboration will empower enterprise and middle-market clients to unlock the full potential of data-driven solutions while enabling Independent Software Vendors (ISVs) with greater capabilities in payment processing and commerce enablement.

The Paypers

OCTOBER 2, 2024

The Financial Conduct Authority has imposed a GBP 29 million fine on Starling Bank as the latter did not meet financial crime systems and controls requirements.

Fintech Finance

OCTOBER 2, 2024

Cardlay , a pioneering Danish fintech company, and Visa , a global leader in digital payments, are excited to announce a collaboration aimed at setting new standards for fast and efficient spend management for commercial cards issuers and their clients. Cardlay and Visa’s referral relationship leverages Cardlay’s innovative white label spend management platform with Visa’s market position, extensive payment network and data capabilities to offer fully embedded commercial cards and expense manage

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

The Fintech Times

OCTOBER 2, 2024

The UAE has ambitions for economic growth by enabling businesses across the country to access faster credit. In doing so it hopes to help firms grow and thrive in a competitive market. In line with this, Magnati , the payments solutions provider in the Middle East has partnered with Wio Bank PJSC , the regional bank providing embedded finance solutions through its merchant financing platform.

Fintech Finance

OCTOBER 2, 2024

Duck Creek Technologies , the intelligent solutions provider defining the future of property and casualty (P&C) and general insurance, today introduced its latest insurance-focused payments solution, the Duck Creek Payments Facilitator. This modern, end-to-end payment solution caters to the nuances of payments within insurance by providing carriers with access to digital payment methods for both collecting and disbursing funds.

Finextra

OCTOBER 2, 2024

US money transfer giant MoneyGram has responded to the UK Post Office's decision to terminate a long-term relationship between the two following a cyber security incident.

Fintech Finance

OCTOBER 2, 2024

Bank of America , a global leader in commercial cards, has expanded its Virtual Payables capabilities in EMEA with the launch of Virtual Payables Direct. The business-to-business (B2B) payment solution provides buyers with the usual working capital advantages of a card transaction – such as extended payment terms – in addition to a new enhancement that allows suppliers to be paid via a direct bank transfer.

Speaker: Becky Parisotto and John Vurdelja

Fulfillment is no longer just about getting products from point A to point B – it's about crafting seamless, scalable, customer first experiences. Flexible fulfillment strategies are more important than ever for those aiming to stay ahead and build resilience as retail enters a new era in 2025. Learn how to optimize fulfillment processes, tackle complex, multi-vendor orders, and create seamless customer experiences – from white-glove delivery for high-value items to quick-ship solutions for ever

Finextra

OCTOBER 2, 2024

Tech giant Meta says it will expand an information sharing partnership with UK banks after a pilot with NatWest and Metro helped take out thousands of scammers on its platforms.

The Fintech Times

OCTOBER 2, 2024

Traditionally, wealth managers have provided professional financial services primarily to affluent clients, offering investment advice and financial planning. However, the emergence of fintech has disrupted this industry, leveraging robo-advisory and advanced artificial intelligence (AI) and machine learning to make wealth management more accessible.

Finextra

OCTOBER 2, 2024

Shares in Payfare plummeted by more than 75% after the Canadian earned wage access firm initiated a strategic review in response to losing its biggest client, DoorDash.

Axway

OCTOBER 2, 2024

Does this sound familiar: your leadership – and customers – expect 24×7 operations. No more downtime. Meanwhile, your Ops and IT teams are overwhelmed maintaining existing systems, patching vulnerabilities, and rolling out updates.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Finovate

OCTOBER 2, 2024

FIS has launched its Digital Trading Storefront, enabling banks, brokers, and fund managers to offer a customizable digital trading experience with real-time execution and enhanced personalization. The new Digital Trading Storefront is built on FIS’s Cross-Asset Trading and Risk Platform. The new tool supports both buy-side and sell-side strategies while helping firms manage trading volumes and mitigate regulatory compliance risks.

Bank Automation

OCTOBER 2, 2024

American Express and Boost Payment Solutions will provide commercial card processing to U.S.-based American Express merchants, the pair announced Sept. 30. Amex merchants will have access to Boost’s straight-through processing solution, Boost Intercept, allowing them to accept virtual cards while avoiding manual processes, Boost founder and Chief Executive Dean Leavitt told Bank Automation News.

Finovate

OCTOBER 2, 2024

Cardlay Payments Solutions has inked a partnership with Visa. The collaboration combines Cardlay’s spend management technology with Visa’s payment network, data capabilities, and market position to drive innovation in spend management for commercial card issuers and their customers. Headquartered in Denmark, Cardlay made its Finovate debut earlier this year at FinovateSpring.

The Fintech Times

OCTOBER 2, 2024

Open finance aims to give third-party providers access to a wider range of financial data, extending beyond just banking services. While it holds promise for more personalised products and improved financial inclusion, its adoption has been slower than expected. Several key challenges, including privacy concerns and a lack of strong advocacy, continue to stand in the way.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Let's personalize your content